Massa - Investor Analysis

Massa Labs is a Decentralized L1 with Autonomous smart contracts and On-chain Decentralized Websites. Thanks to transaction sharding and a multithreaded DAG, It solves the scalability issue.

Executive summary

New investment opportunity - Massa Labs - round: $5.8 Mil Seed for 10%, Raising Strategic Round.

- Homepage: https://massa.net/ Since 2018; Technical paper; Founding; Intro guide

- Product: On chain Decentralized websites; Autonomous smart contracts

- Explorer: https://massa.net/testnet/ e masscan (in development)

- Wallet: https://bearby.io/

- Use-Case: Transaction sharding and a multithreaded block DAG. It solves the scalability issue by parallelizing the data structure and adapting the consensus rule. High TPS, Decentralized L1 with Autonomous smart contracts.

- Consensus: Blockclique-specific consensus mechanism derived from the Nakamoto consensus rule.

- Language: Rust

- Team: Mainly AI Academics no relevant Crypto experience- Sebastien Forestier - CEO - PhD in AI; Adrien L. - CSO - Ph.D. in quantum physics; Damir Vodenicarevic - CTO - Prev. AI and Data scientist Treezor (bank); Gregory Libert - CIO - Prev. CTO Treezor (bank)

- Funding Round & Valuation: Raised 5.8Mil, 11/11/2021

- Investors: BlueYard, Acecap, Numeus, Charlie Songhurst, Dascof, Mediapps, Ariane Capital, Andurance Ventures, Aussie Capital, ZBS Capital, Bpifrance

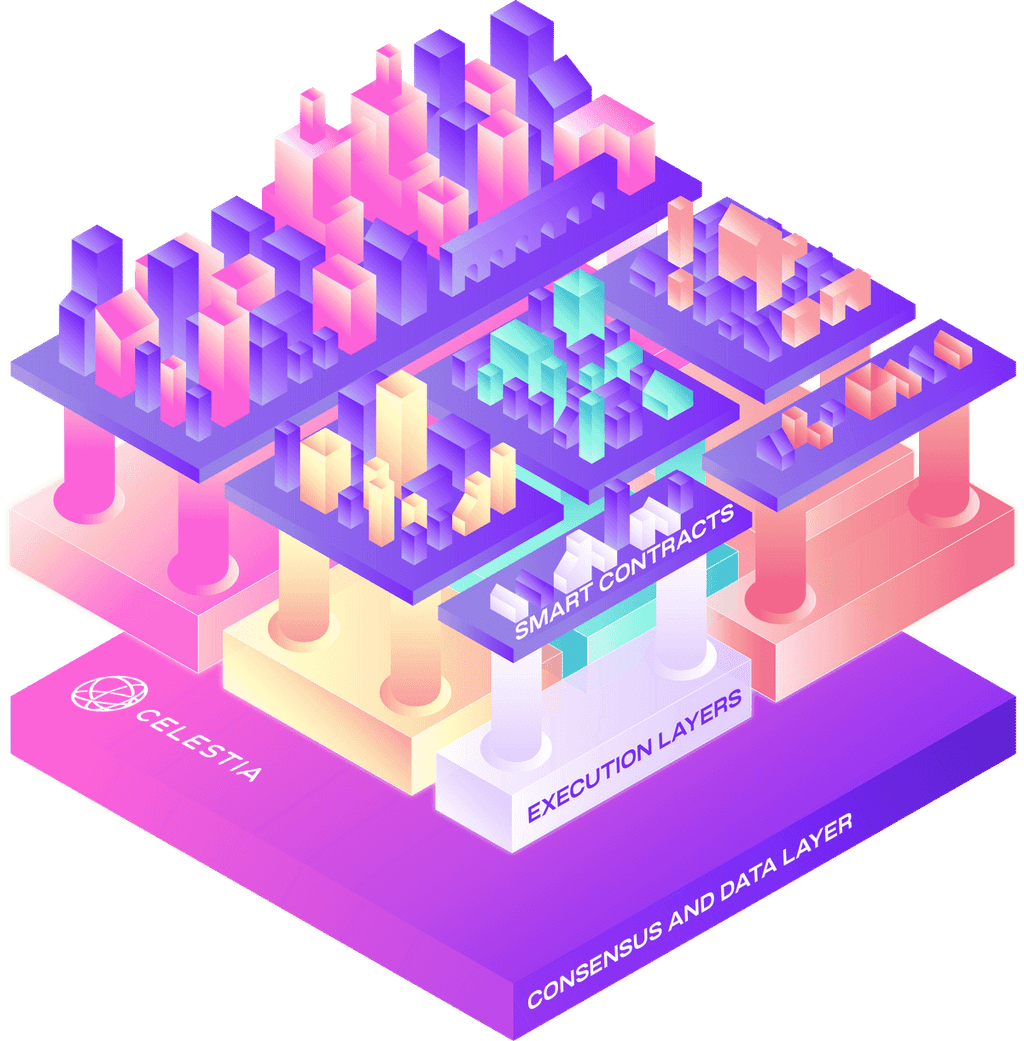

- Competitors: Celestia (data availability), SEI network (block parallelization), Quai Network (High TPS with PoW), Avalanche (Sub-second time to finality)

Valuation

- Pros:

- Clear applications with Decentralized Web hosting and Autonomous Smart contracts.

- Decentralized with a good number of Nodes (5k) and a well Distributed cap table.

- MVP Smart Contract Playground - to attract developers and testers

- Cons:

- Unclear Nakamoto coefficient statement (> 1000). Besides the number of nodes and the distribution of the backers, this claim is not proven.

- Traction with ecosystem partners is yet to build.

Relevant Notes:

- Team Check: Great team, no relevant crypto exp. CIO, CCO and CTO are Coming from Treezor (Open Banking services - Payment - Acquiring, SEPA, KYC)

- Product delivery (state of dev.): Massa testnet was released in July 2021. with Multiple iterations, reaching 6K Validator Nodes.

- Founding: One of the most distributed seed round with 100 token buyers from 18 countries, raising €5M ($5.8M), with a small ticket cap.

- Token utility: Validating the network, not announced yet.

Deal Structure

- Raised $5.8 mil seed round.

- Raising a Strategic Round on a $200mil post-money valuation

Product Use case

- Tech Design: Blockclique → parallel blocks in a multithreaded block graph (DAG), while transaction sharding ensures that transactions of parallel blocks are compatible by construction.

- In this new block structure, nodes can still create forks in particular threads by creating two incompatible blocks in the same thread with the same parent in that thread. Extend the Nakamoto rule to allow nodes to reach a consensus about the global set of compatible blocks (called “clique”) of maximum fitness.

- Differences to other DAGs: In contrast to previous blockchains based on a DAG architecture, the multithreaded block DAG with transaction sharding and an adapted consensus rule allows to fully benefit from block parallelization and does not require giving special privileges to some nodes.

Simulation Results: 10.000 TPS

Problem:

- Data availability and Scalability - Small block size, with the Nakamoto consensus rule, leads to limited block processing

Features:

- On-chain Decentralized websites

- Autonomous smart contracts

- Send message for future execution (with a Listener)

- Dapps: Dusa (AMM), Star Origins (game)

Team

CORE TEAM

- Sebastien Forestier - CEO - PhD in AI

- Adrien L. - Ph.D. in quantum physics from Université Paris Diderot - researcher

- Damir Vodenicarevic https://www.linkedin.com/in/damir-vodenicarevic/ - CTO - Prev. AI and Data scientist Treezor (banking services)

- Gregory Libert - CIO - Prev. CTO Treezor

- Jonathan Quali - Head of Ecosystem - Prev. 7 yr. Marketing exp.

Analysis by Mark Mercatali. Disclaimer: This analysis is based on personal opinion only. This is not intended as investment advice. Do your own research. All company data is owned by the respective owners.