SUI - Mysten Labs - Investor Analysis

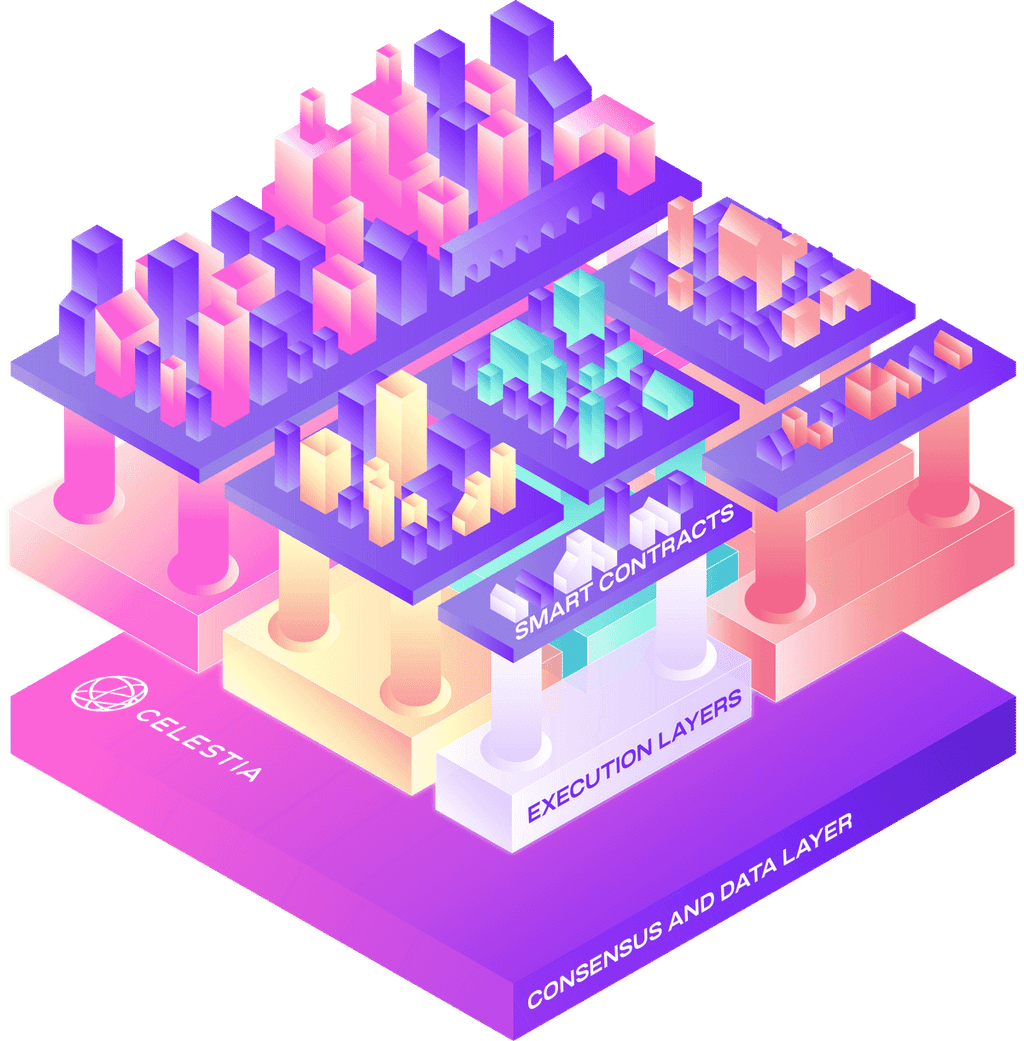

Layer 1 Blockchain Infrastructure. Allowing to scale horizontally from dynamic games to DeFi protocols. Set to launch an NFT platform.

Executive summary

New investment opportunity - SUI - raised $336M at $2Bn Valuation

- Homepage: Sui Blockchain - Build without boundaries MystenLabs - Creating Foundational Infrastructure For Web3.0

- Explorer: Sui Explorer Use Sui Explorer , Wallet announced

- Product: Layer 1 Blockchain Infrastructure. Allowing to scale horizontally from dynamic games to DeFi protocols. Set to launch an NFT platform.

- Language: Move is Rust-inspired and designed for smart contract development. Move is a platform-agnostic language.

- Protocol Consensus: Narwhal and Tusk: A DAG-based Mempool and Efficient BFT Consensus

- Stats: Twitter 57 K Followers, 93k Discord.

- Funding Round & Valuation: Mysten Labs has raised a total of $336M in funding over 2 rounds. Their latest funding was raised on Sep 8, 2022 from a Series B round.

- Investors: Anderseen Horowitz, Coinbase ventures, Electric Capital, Lightspeed Ventures, NFX, Redpoint, Samsung NEXT, Scribble Ventures, Slow Ventures, Standard Crypto, Ethos Family Office

- Competitors: Aptos, Avalanche, Solana

- Pros:

- Interesting (yet to be tested) economic model (Gas price mechanism) Sui users pay separate fees for execution (Dynamic Price setting) and storage (governance proposals)

- Superstar Team (Ex. FB, Google Play etc)

- Highly anticipated brand with proprietary language

- Cons:

- No Traction stats yet (Validators and wallet downloads)

- High Distribution for insiders (Highly VC backed)

Product

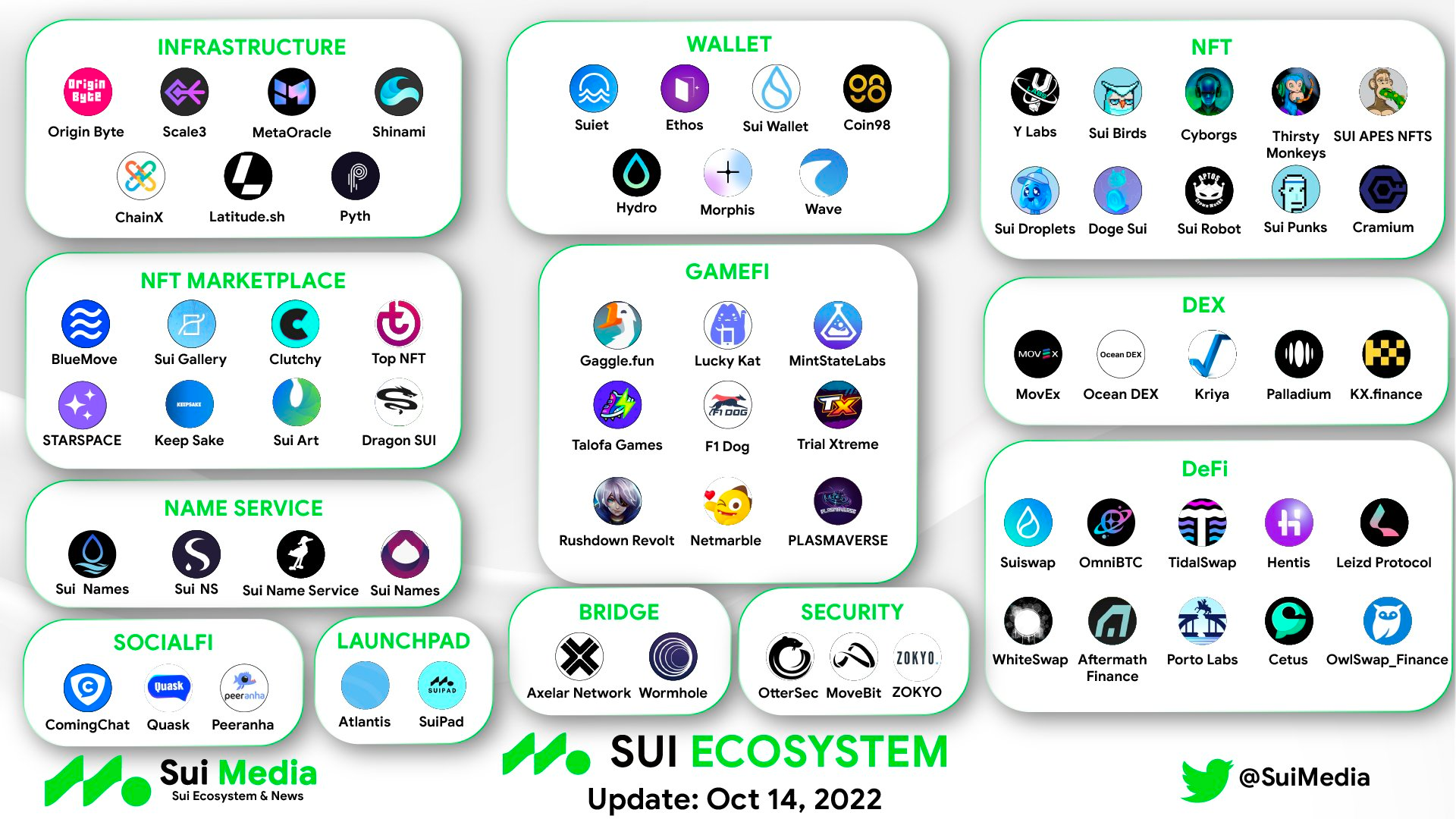

Ecosystem

Smart contract whitepaper

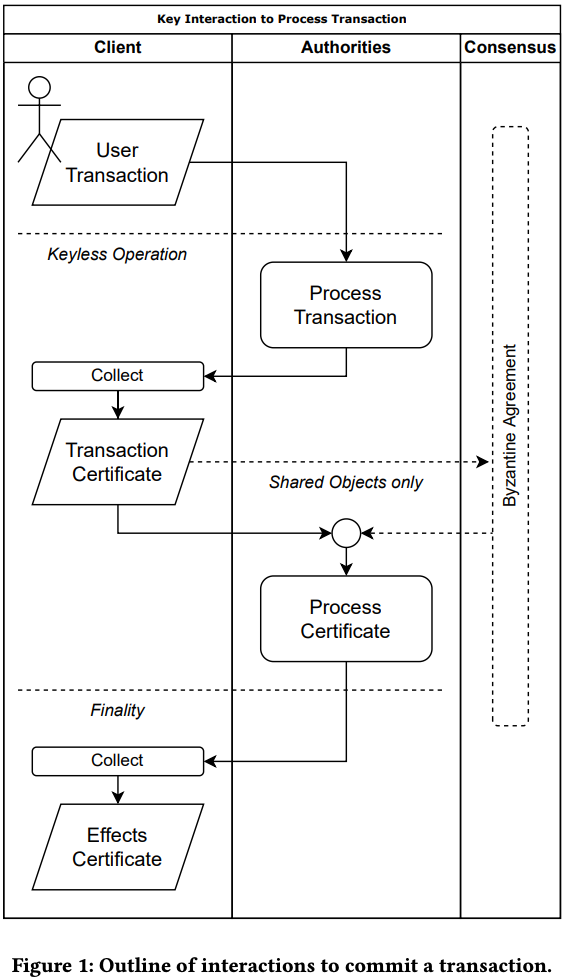

Transaction processing

Core protocol: Evolution of the FastPay.

FastPay allows a set of distributed validators, some of which are Byzantine, to maintain a high-integrity and availability settlement system for pre-funded payments. It can be used to settle payments in a native unit of value (crypto-currency), or as a financial side-infrastructure to support retail payments in fiat currencies. This is not the protocol Sui uses, yet it proposes the basic safety mechanism that Sui extends. FastPay is based on Byzantine Consistent Broadcast as its core primitive, foregoing the expenses of full atomic commit channels (consensus). The resulting system has low-latency for both confirmation and payment finality. Remarkably, each validator can be sharded across many machines to allow unbounded horizontal scalability.

Consensus - Narwhal and Tusk: A DAG-based Mempool and Efficient BFT Consensus

When full agreement is required we use a high-throughput DAG-based consensus.

We propose separating the task of reliable transaction dissemination from transaction ordering to enable high-performance Byzantine fault-tolerant quorum-based consensus. We design and evaluate a mempool protocol, Narwhal, specializing in high-throughput reliable dissemination and storage of causal histories of transactions. Narwhal tolerates an asynchronous network and maintains high performance despite failures. Narwhal is designed to easily scale-out using multiple workers at each validator

Tusk, a zero-message overhead asynchronous consensus protocol

Explorer

Our Sui Explorer is designed to accomplish the following:

- Keep the most updated and accurate on-chain data, activity, and metrics

- Enable lookup, verification, and tracking of all assets and contracts

- Be a fast, reliable, and transparent tool for debugging and auditing

- Offer useful smart contract development and features unique to Sui Move

Tokenomics

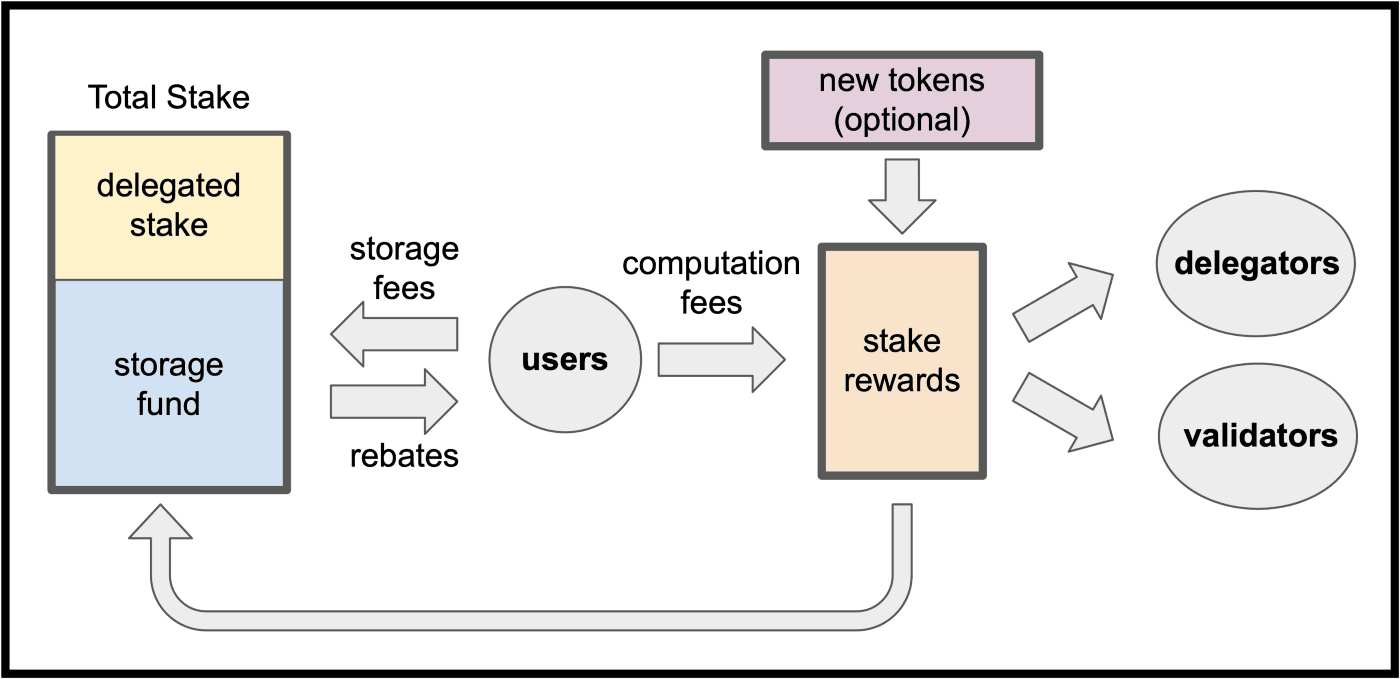

SUI Economic Model

- Sui’s Gas Pricing Mechanism

A unique feature of Sui’s gas mechanism is that Sui users pay separate fees for execution and storage. Execution or, computation, gas prices are determined through a three-step process operating repeatedly across Sui epochs (time is divided into consecutive periods lasting roughly 24 hours each)

Sui users can expect transactions submitted with gas prices close to or at the reference price to be processed promptly. Moreover, since Sui incentivizes validators to set low prices, Sui’s gas price mechanism creates a healthy competition for fair prices: Validators are incentivized to set low gas prices but not too low — lest they be penalized for failing to honor such prices.

- Storage Fund

Sui’s economic design includes a storage fund that redistributes past transaction fees to future validators. In a nutshell, users pay fees upfront for both computation and storage. The storage fees are deposited into a storage fund used to adjust the future share of stake rewards distributed to validators relative to SUI delegators. When on-chain storage requirements are high, validators receive substantial additional rewards in order to compensate for their costs. Vice versa when storage requirements are low.

Deal Structure

Mysten Labs has raised a total of $336M in funding over 2 rounds. Their latest funding was raised on Sep 8, 2022 from a Series B round.

Dec 6, 2021 | Series A - Mysten Labs Raised: $ 36,000,000 | Anderseen Horowitz, Coinbase ventures, Electric Capital, Lightspeed Venture Partners, NFX, Redpoint, Samsung NEXT, Scribble Ventures, Slow Ventures, Standard Crypto, |

Jul 26, 2022 | Ethos Family Office | |

Series B - Mysten Labs

Raised: $ 3000,000,000 |

Team

The founding team has extensive experience in web3, programming languages, distributed systems, and cryptography. CEO Evan Cheng led Novi Research, Meta’s crypto R&D division, where he worked with Mysten’s other co-founders (Sam Blackshear, Adeniyi Abiodun, and George Danezis) to develop the Diem blockchain and Move programming language, as well as enable breakthroughs in blockchain scalability, usability, and security. Their experience also spans industry-leading companies such as Apple, Microsoft, VMware, Oracle, J.P. Morgan; and crypto startups such as Chainspace, Vega, and Nym.

Resources

Analysis by Mark Mercatali. Disclaimer: This analysis is based on personal opinion only. This is not intended as investment advice. Do your own research. All company data is owned by the respective owners.