Executive summary

New investment opportunity - R4W W4R (R4W) - round: $600K Seed for 3%

- Homepage: www.rawwar.ch

- Product: RaW WaR is the first playable videogame in Real Life that harnesses IoT devices, provides a gameplay experience supported by a proprietary streaming platform and Tiered NFTS.

- Use-Case, 2 main types of Consumers:

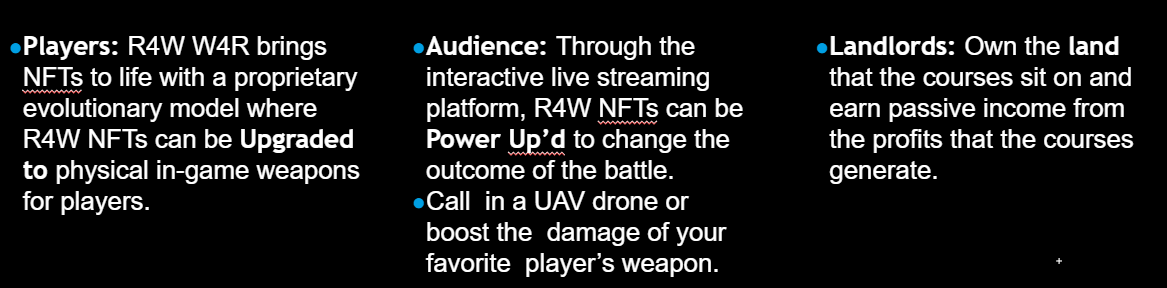

- Players can enjoy real-life military simulation courses while gaining exposure to digital NFTs.

- Spectators can follow the game remotely and interact in real-time via a proprietary streaming platform, thanks to the native token.

- Monetization: Battle pass and event tickets sold to Players and spectators (Pay to play and rent weapons at the Courses); Marketplace sales (In-game Points, NFTS 2.5 % fee from all txns and Power-ups); Extra: Sponsors and ads

- Country: Z Corp SA registered in Switzerland, Lugano https://www.zefix.ch/it/search/entity/list/firm/1492713 10.06.2021

- Stats: Twitter: 1.666 Members; TG: 525 Member; Discord: 869 Members

- Funding Round & Valuation: Raising $600K in exchange for 3% on a $20,000,000 post-money valuation (Seed)

- Investors: Seed-investor - Friends & Family https://www.zefix.ch/it/search/entity/list/firm/1422232 - www.hetica.capital. 100K in exchange for 0.5% (To be confirmed)

- Competitors: NA

- Ticket: NA

- Timing: NA Request allocation by XX , sign and wire by YY

- Pros:

- Advanced Real-life Tech (Laser, IoT)

- Incentivized interactive streaming

- broad network of Influencers

- GamFi dynamics (Stake to earn NFTs)

- Various revenue streams (tickets, transactions, ads, betting, lands)

- Solid team

- Cons:

- Small IDO token allocation, can lead to low Distribution (Team holds 46.50%)

- Early stage product with limited traction/ yet to be tested.

- High inflation: Lots of selling pressure is expected when after the vesting period. (MC/FDMC ratio)

- No protocol fee sharing with token holders.

- Dependent on constant demand of Real-life players

- Region dependent (CH and IT), Italian speaking audience

- Game rewards and staking yields are blocked for 1 season

Product Use case

R4W W4R is a military simulation sport where players compete in team battles with the objective of eliminating the opposing players.

Target: Younger generations are disinterested in watching and playing sports and prefer streaming and playing video games. Combining digital gaming and sports

R4W W4R is creating a cross-reality NFT

Ecosystem :

- Real-life game players

- Spectators

- Merchants and Yield farmers

- Marketplace: sell or rent weapons

- Landlords: own the courses

- Artisans

NFTS:

Raw War weapons and gear evolve from digital NFTs to physical in-game assets in a proprietary 4 step model:

- Level 1: NFT Blueprint is Minted

- Level 2: NFT is equipped with Color / Camouflage

- Level 3: NFT power is increased

- Level 4: NFT becomes a Stake-to-Earn Asset yielding additional NFTs, points, or Tokens.

- Burn: NFT is Burned to generate real-world weapon for in-game competition

Business model

Main monetization

Breakdown:

- Battle pass

- Pay to play and rent weapons at the Courses

Customers: Mainly Players, spectators

Frequency: Every battle season

- Marketplace sales

- In-game Points. Customers: Spectators and players. Frequency: In-game marketplace

- NFTs: 2.5 % fee from all txns

- Extra

- Sponsors for events

- Advertisements in the streaming app

- Betting fees

- Entertainment marketing

- Land sales

Details

Tokenomics

Token utility

One liner: In-Game Purchases and Marketplace exchanges.

● Event Tickets are purchased by players with R4W Tokens

● Marketplace Exchanges are facilitated in R4W Tokens

● Power-ups are purchased by Spectators with R4W Tokens

● NFT Upgrades are purchased by Players with R4W Tokens

● NFT Land is purchased by landlords with R4W Tokens

● Battle Pass is purchased seasonally by players with R3W Tokens

● Stake R3W token

● Convert into R4W Points

● DAO vote on location and rules of the game

● Bet on the outcome of matches with R4W Tokens

W4R Points

To compete in tournaments, players and clans work to earn W4R Points which are exchanged for an all-inclusive trip to an R4W W4R course.

W4R Points can also be used for Purchasing, Farming and Upgrading NFTs .

W4R Points are earned through:

- Staking

- Social mining

- Farming

- Playing

Reward mechanism:

Based on ranking, distributed end of the the season, discretionary.

Token Analysis

- Token type: Utility token

- Intended use case: In-Game Purchases and Marketplace exchanges.

- Market cap at TGE: 740.000$ Fully diluted Market Cap at TGE: 50.000.000$

- MC/FDMC ratio: 0.02 High future inflation. The discrepancy between MC and FDMC is significant, thus we can expect that many new tokens will experience a lot of selling pressure when unlocked.

- Allocation and distribution

- Pre-minted or Fair launch: Fair launch

- Hard-caps or Airdrops (Inflationary or deflationary): Hard-cap 1bn

- Team: 46.50%, Rewards: 34.40%

Distribution:

Public sale is limited to 1.5%, Community allocation (Ecosystem funds or airdrops) is not specified (Somewhere between 1 and 9%, including Marketing expenses)

- Token velocity and Instrinsic value

- Token velocity is high since R4W token is the mean of exchange that facilitates the marketplace and game purchases.

- Solutions adopted: 20% of Revenue generated will be burned, but the same amount will be unlocked, maintaining the circulating supply but not decreasing velocity. No staking data is provided

Intrinsic Value | Speculative Value | ||

How well does the token fulfill the premises that it set out to fulfill? | 1. Constant demand for course access thus R4W points

2. Streaming services are supporting multi-cultural communities and a broad range of clans/teams

3. Proprietary streaming platform attracts spectators (vs Twitch etc) | Will the token be worth more money in the future? | NA |

Does the token provide value in it’s market sector? | Not yet, Specific market sector yet to be tested. | Will the project provide value in its market sector? | NA |

Do people use the token for its intended purpose? | NA | Will there be enough liquidity to make a return ? | NA |

Questions regarding tokenomics:

- How the project plans to reduce velocity? (when and how staking will be implemented)

- Please provide info on reserve. Why the allocation to Listing and Market making is very high (7%)?

- Where the token is going to be listed? (any DEXs?)

- Please provide info on Community found allocation?

- Why rewards are locked until the end of the 1st season?

- Tickets: what if users want to have access to the premise using FIAT? How demand can be maintained, beside influencers ?

- how long is the duration of each “gaming season”?

Deal Structure

Raising $600K in exchange for 3% on a $20,000,000 post-money valuation (Seed) (If 100K raised equals to 0.5%)

● Seed - 35 Mil $RAW - 0,02 $

6 months cliff, 12 months vesting

In exchange for 3.50% allocation, on a $20,000,000 post-money valuation

● Private sale – 55 Mil $RAW - 0,03 $

5% at TGE, 3 months cliff, 12 months vesting

In exchange for 5.50% allocation

● Community sales– 88 Mil $RAW - 0,04 $

10% at TGE, 3 months cliff, 9 months vesting

In exchange for 8.80% allocation

● IDO – 13 Mil $RAW - 0,05 $

25% at TGE, 3 months cliff, 6 months vesting

In exchange for 1.50% allocation

Team

CORE TEAM

- Domenico Formichetti Co-Founder / Art Director - Italy Notes: Active in NFT and Fashion business.

- Domenic Weiss Guns Engineer, military consultant

- Pablo Pfister Project manager - Switzerland - Extensive experience in crypto

- Marco Natolli Senior designer - Italy - From Hetica

Member of the board https://www.hetica.capital/it/

Seeder company: Hetica Capital, (Friends & Family)

Raw world alliance:

- Domenico Formichetti (Co-founder): https://www.instagram.com/dformichetti/www.formystudio.com. https://www.nssmag.com/it/sports/27699/formy-studio-kit-fifa-22

- Tedua https://www.instagram.com/tedua_wildbandana/ Notea: Lead from Domenico F. (His Personal stylist and designer).

Others influencers:

- Yuri pennisi https://www.instagram.com/therealyurins/

Localisation

Mainly targeted to Italian speaking audience. Courses are based in Swizerland.

Comparable

Notable differences:

Raised $5M in a seed round co-led by Sequoia Capital and Folius Ventures with the participation of Solana Capital, Alameda Research, 6th Man Ventures, DeFi Alliance, M13, Corner Ventures, Sfermion, Zee Prime Capital, Lemniscap, Spark Digital Capital, MorningStar Ventures, Openspace Ventures, Solar Eco Fund and WelinderShi Capital with prominent Angel investor of Santiago R. Santos. https://www.crunchbase.com/organization/stepn/company_financials.TW: 354.9K Discord: 322.6K

GMT Burning Mechanics (Governance)

NFT

- Burn GMT to reach level 5/10/20/29/30

- Burn GMT to upgrade Level 4+ Gems

- Burn GMT to mint ALL Sneaker qualities

- Burn GMT to re-distribute Attribute points

Enhance In-app Mechanics

- Burn GMT to permanently increase GST Daily Earning Cap

- Burn GMT to permanently improve success rate of ALL Gem upgrade

- Burn GMT to permanently improve the chance to receive a higher quality Sneaker from opening Shoebox

- Burn GMT to permanently improve the chance to receive TWO Sneaker from Shoe-Minting

GST Burning Mechanics (Utility)

The GST is burned by:

- Shoe-Minting

- Repair

- Leveling up Sneakers

- Gems upgrade

- Unlocking Socket

Game Token: GST

Governance Token: GMT

Rationale for investment:

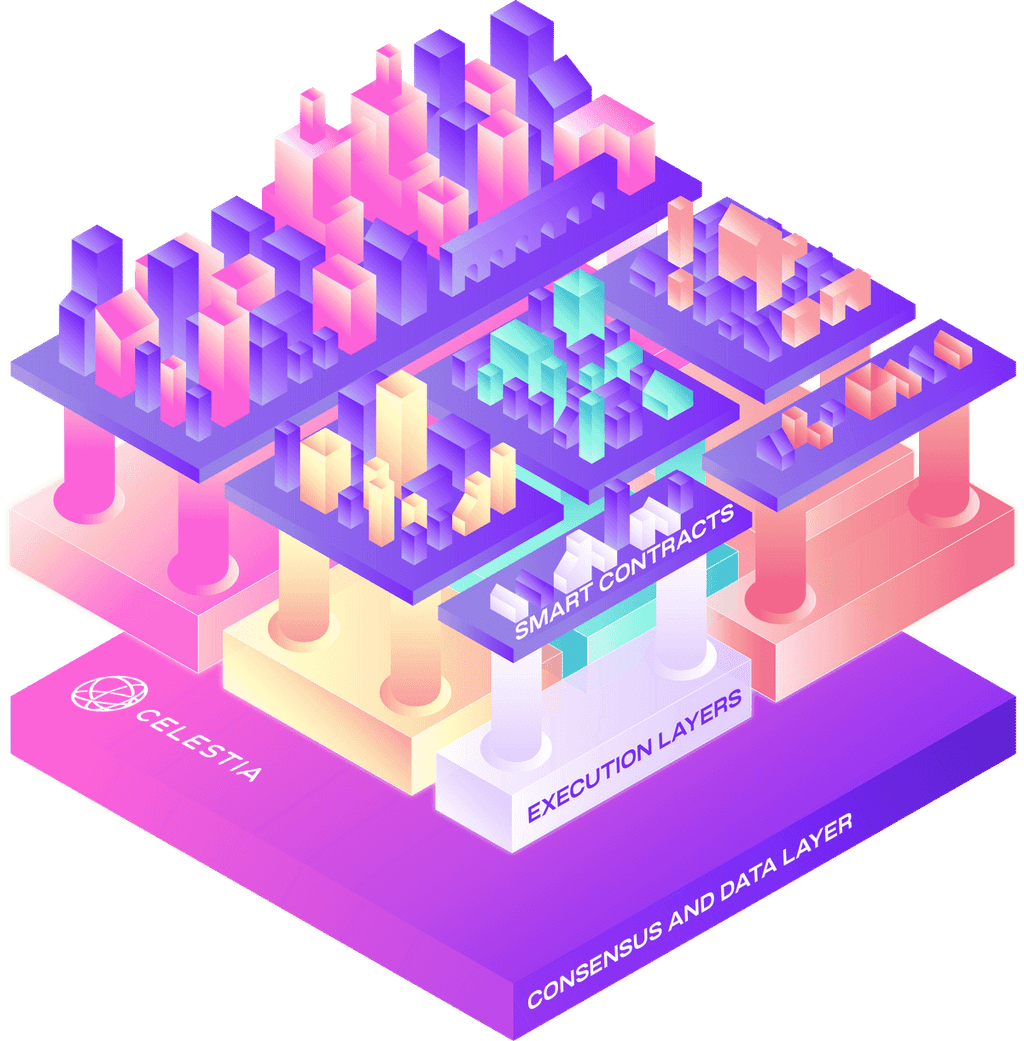

- Tech: Layer 4 is a new paradigm that transcends blockchain and becomes interconnected with our physical reality. Applications are built to operate across dimensions

- Innovation: Play to earn, interact with the real-life game, hold and stake Weapon NFTs.

- Various revenue streams, one or more of them could be profitable.

Analysis by Mark Mercatali. Disclaimer: This analysis is based on personal opinion only. This is not intended as investment advice. Do your own research. All company data is owned by the respective owners.

Table of contents: