SEI Network - Investor Analysis

Executive summary

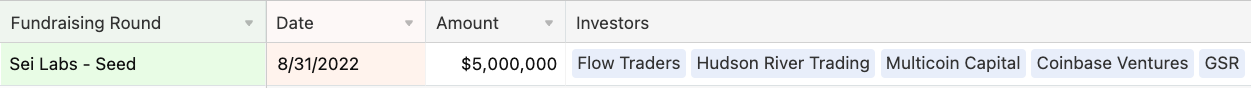

New investment opportunity - SEI Labs - Seed round - $5 Million

- Homepage: https://www.seinetwork.io/, Whitepaper, https://github.com/sei-protocol https://github.com/sei-protocol/sei-chain

- Explorer: Test-net https://sei.explorers.guru/; https://testnet-explorer.brocha.in/sei/ -

- Product: Sei Network is the first orderbook-specific L1 blockchain, custom-built for DeFi applications. Features a built-in order-matching engine, frontrunning protection, and the fastest finality of any chain (600 ms).

- Language: Go

- Protocol Consensus: Tendermint +

- Stats: Twitter: 33K, Discord: 4.6k , Telegram: 4.3k; Since launch in July → 58 Active Validators (2000 Test-net validators); 25k Test-net users

- Investors: $5 million funding round led by Multicoin Capital with participation from Coinbase Ventures, Delphi Digital, Hudson River Trading, GSR, Hypersphere, Flow Traders, Kronos Research and the founders of Anchorage, Frax, Yield Guild Games, and Tangent.

- Competitors: Maverick Protocol, Injective, Serum, DyDx

- Roadmap: Main-net Q1 2023 target

- Pros:

- DeFi specific environment build on Cosmos SDK

- Cross-chain integration (IBC and Solana trough Nitro L2)

- plug-and-play into the Sei order matching engine and access pooled liquidity from other apps.

- Cons:

- The first mover, Injective, has great traction and stat, this could lead to a high barrier to entry into the IBC ecosystem

- No Tokenomics info out yet.

- Not clear on which ecosystem they want to relay (switching btw Cosmos, Solana etc) why airdrop to Solana users?

Product Use Case

Target

DEX Exchanges

Cosmos SDK and Tendermint core and features a built-in central limit orderbook (CLOB) module. Decentralized applications building on Sei can build on top of the CLOB, and other Cosmos-based blockchains can leverage Sei’s CLOB as a shared liquidity hub and create markets for any asset. Sei will act as an infrastructure and liquidity center for the Cosmos ecosystem’s next generation of DeFi products.

Ecosystem

- Collab announced - @Nitro_Labs will deploy its scaling solution on Sei serving as a portal for the #Cosmos and #Solana communities.

Nitro lets developers deploy existing Solana smart contracts with no changes, while users can seamlessly access these apps with Solana wallets.

Incubated by contributors at Sei Labs, Nitro provides a platform for Solana developers looking to expand to the IBC markets.

- 50 Million Ecosystem and liquidity fund to support new decentralized finance (DeFi) applications on its platform.

Features

- Latency & Throughput

- Overloading Tendermint: Sei the fastest chain to finality (600ms)

- DeFi-specific parallelization: massively increases throughput and order processing

- Optimistic block processing: heavily decreases block latency

- Mev Protection

Frequent batch auctioning: rather than executing each order one-by-one (as would happen on Ethereum or Solana). Sei can aggregate every order together at the end of the block and execute all market orders at the same price to help prevent frontrunning

- Developer and User Experience

Native price oracles: built into the chain itself for high quality and reliable data feeds

Single block order execution: on Serum, apps need 1 transaction to place an order (adding it to a queue) and then another transaction (in another block) to “turn the crank” for order execution. Sei collapses that into 1 block for faster order execution.

Multiple levels of order bundling: to minimize gas costs so market makers and pro traders on apps built on Sei can submit 1 transaction to update multiple markets

Multi-Token Gas: gas can get paid with multiple token options

Unique Value proposition:

General purpose advantages:

1. Atomic composability - all apps are built on 1 blockchain so can easily work with each other

2. Social coordination - the ultimate unlock. single core community with a single schelling point

App-specific advantages:

1. Customizability - if you're building a chain around a single app, you can change things up

2. Native, multi-chain interoperability - the power of IBC

Sei combines the advantages of general purpose Layer 1's with those of app-specific chains

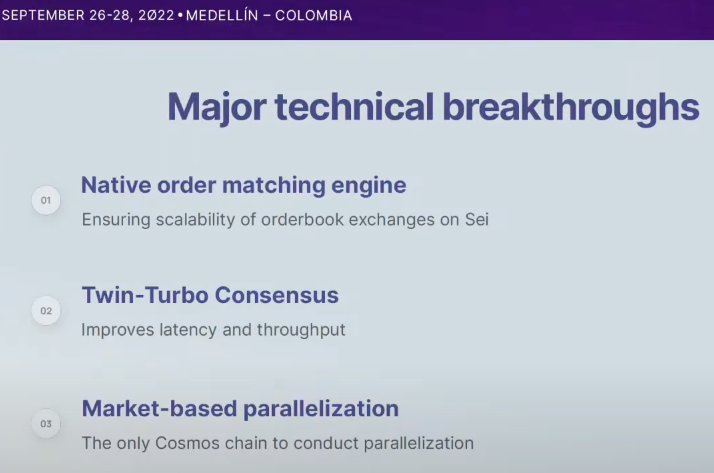

Major Tech Innovation:

- Native Order Matching

- Twin-Turbo Consensus

- Market-based parallelization

Order matching is the heaviest L1-level operation on Sei. Since performance is of paramount importance for an exchange, we implemented parallel order matching to speed up the process. Different trading pairs will have their order-matching process running in parallel in DEX module's

EndBlock section.Core Architecture

Twin-turbo consensus

A. Intelligent block propagation

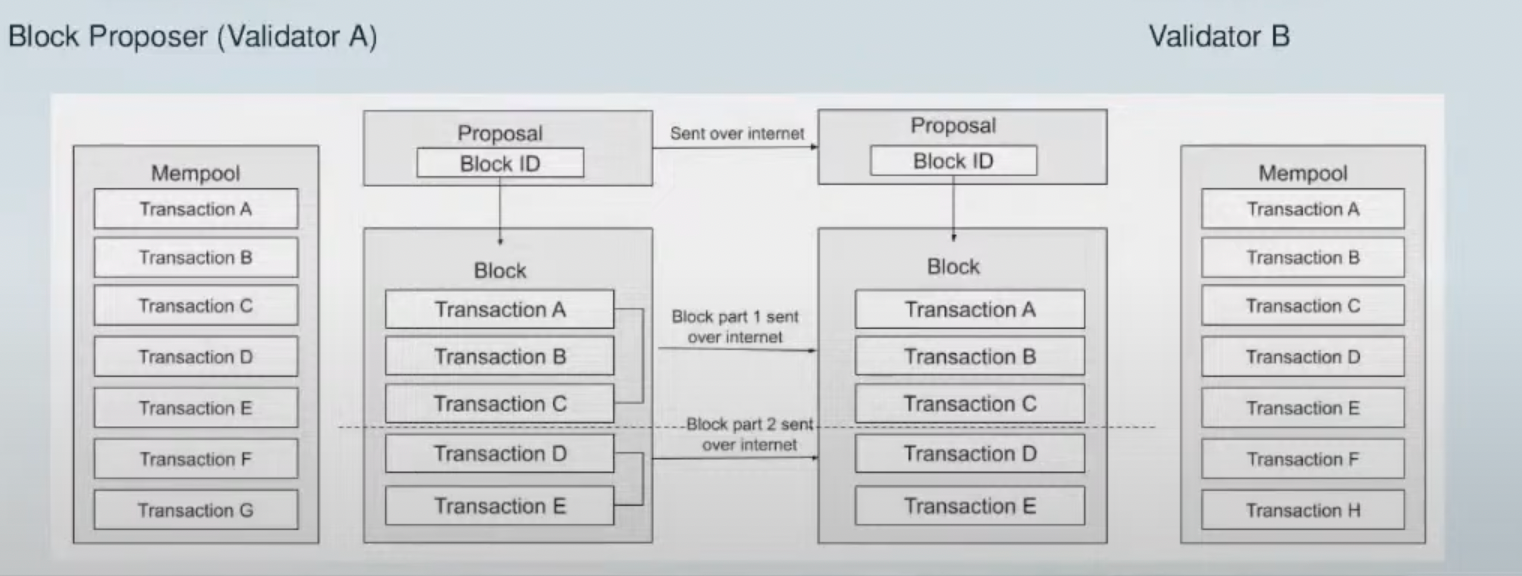

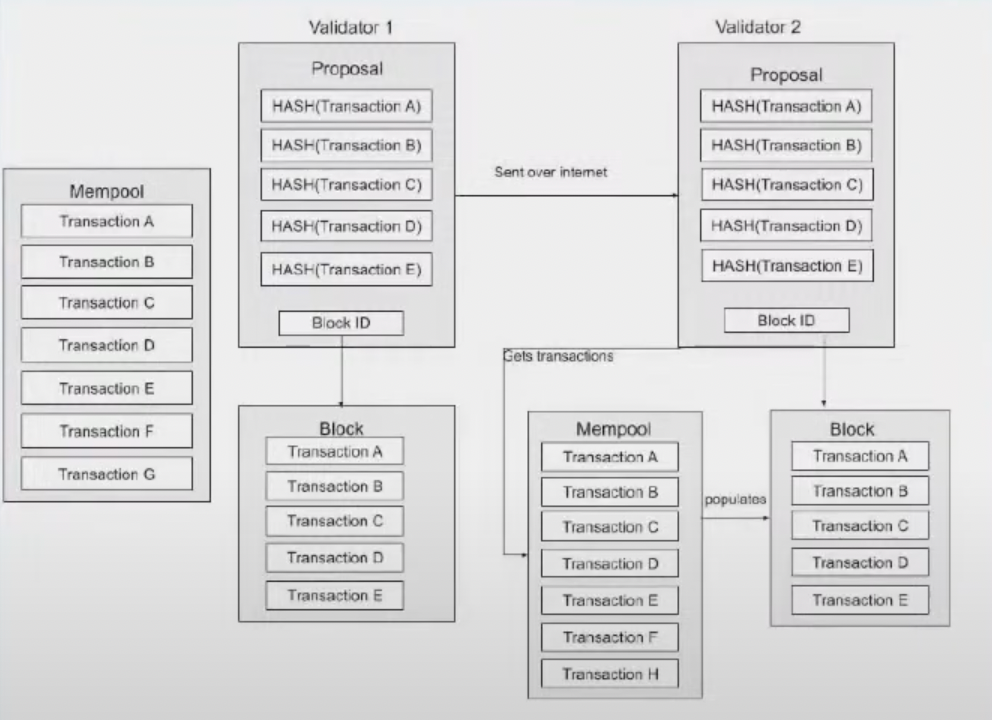

Regular Tendermint Block Proposal:

The Block proposer (Jay) and Validator (Dan) have 2 mempools and have the following block proposal Flow:

Validator (DAN) receives the Block proposal from JAY (with the Hash - Block ID) → Waits → receives the 1st chunk (Part of the txn of the Block)→ Waits → receives the 2nd chunk.

While Txn A→E are what is getting sent, DAN has already all this content (From a internal research: 99.9% of the txn are in the Mempool)

This is inefficient - Validators due to network latency have to wait for data that they already have

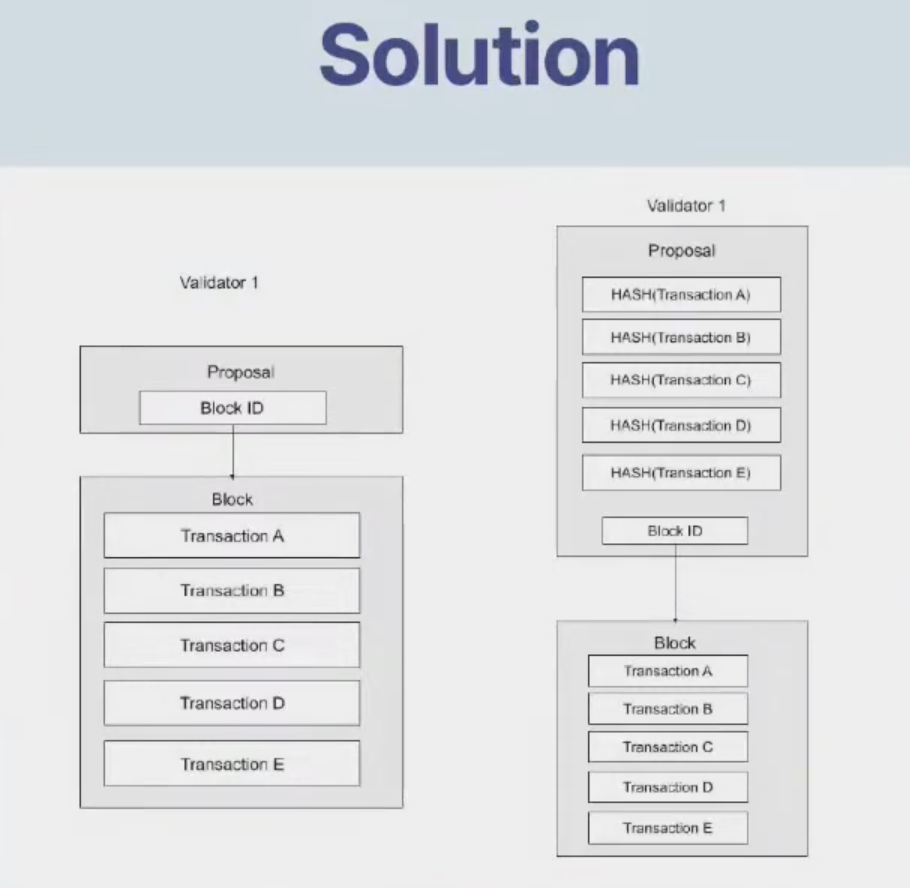

SEI Consensus - Change the block proposal for increased Throughput

The first part remains the same (Block proposer (Jay) looks for txn in his mempool, forms a block and propose it to the network)

Then Block proposal has hashes of txn, and the Validator already has this txn in his mempool rather than waiting the block chunks (network latency)

- Optimal Solution: Hashes of Txn from TXN A→E are included in the block proposal, so the validator can construct the block locally (with the mempool data)

- 0.01% Case: The Validator will Fallback to the same mechanism previously used (as Normal tendermint)

Sei observed nearly a 40% increase in throughput

B. Optimistic Block processing

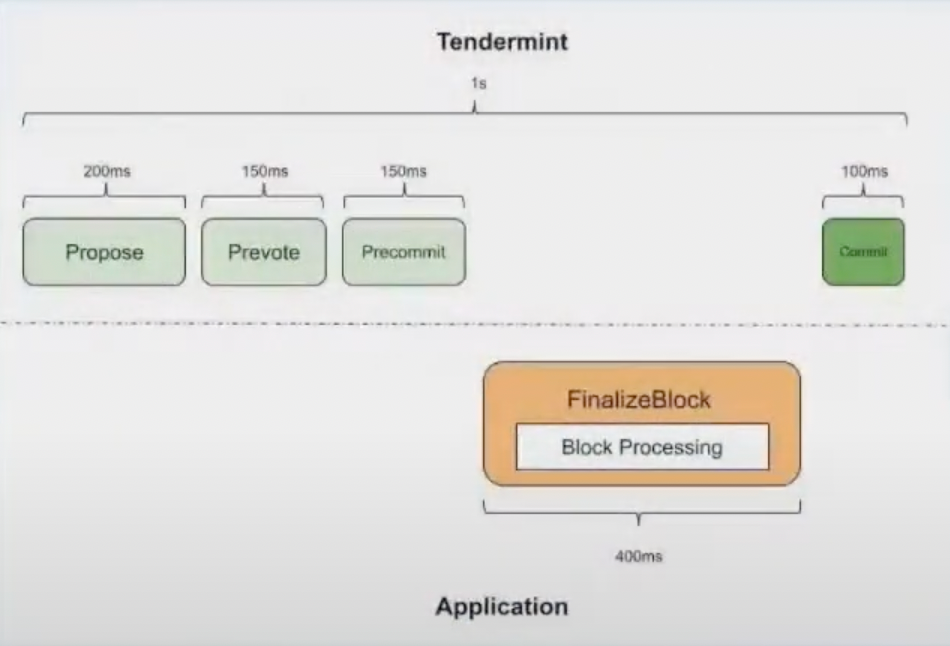

Regular Tendermint Block Processing:

Block Proposal JAY Sends the block to the Validator DEN

Den will run some sanity checks on it (Holding on to the block) → vote on the block through prevote and pre-commit → then starts processing the block.

The validators hold to the block, without doing anything with it during the length of Prevote and Pre-commit (around 150ms each).

This is inefficient - Validators are waiting for the entire length of prevote and pre-commit without starting to process the block.

In the case of lots of adverse byzantine nodes on the network is better to not do anything.

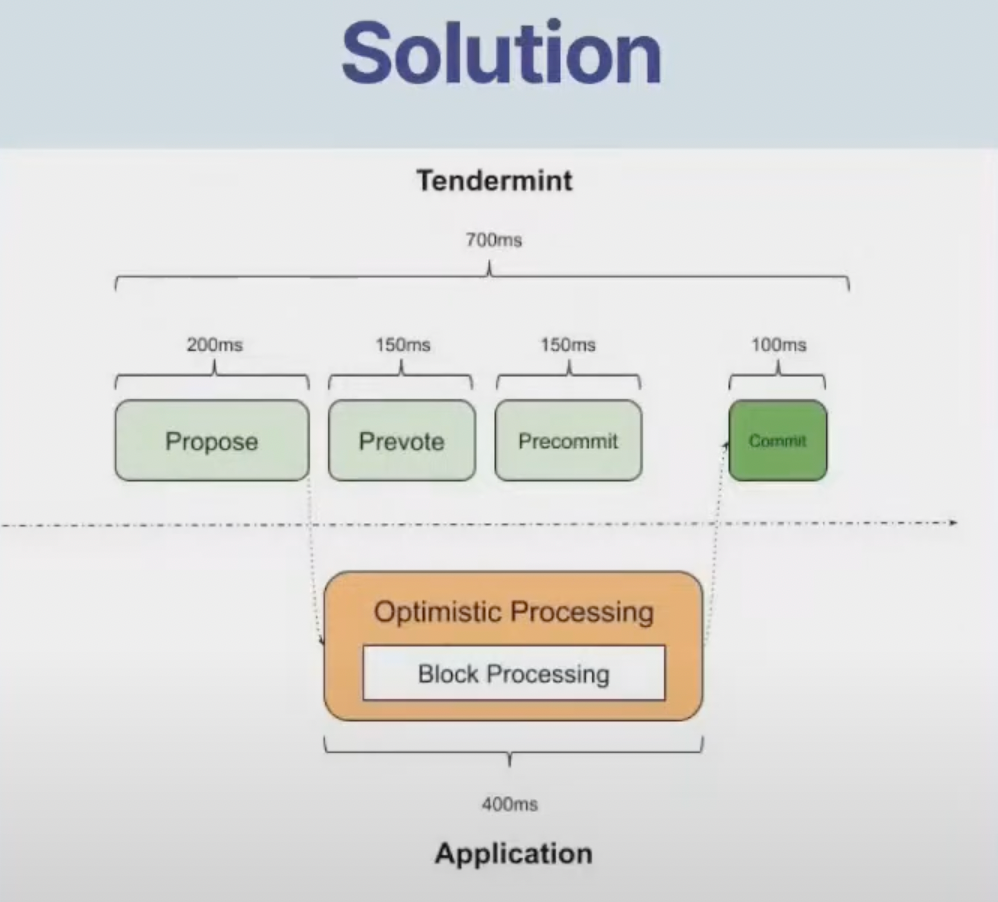

Sei noticed that most of the time the 1st block is the one that ends up being processed (with the most votes on it)

SEI Consensus - Change the block processing for lower latency and faster block time

- Optimal Solution: Optimistic Processing→ While the prevote and pre-commit are happening, at the same time the Validator is processing the block →Block is processed faster and the state updates are faster. Overall latency goes down.

- In case of a malicious node or a validator makes a mistake: Validators are taking the proposal, updating a candidate state, if the proposal is successful they will commit that state, if not the state will be discarded. Next round, at any given height, the block will be processed the normal way as after pre-commit.

Sei observed nearly a 33% increase in throughput

Performance achieved: 22,000 orders per second with 450 ms block times.

Tokenomics

Token Analysis

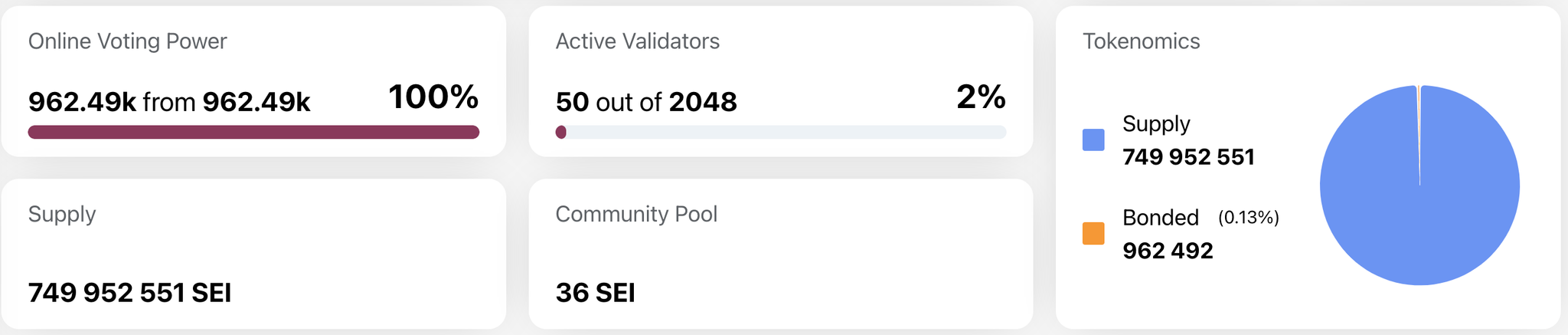

One liner: Not released yet

749.95M Total Supply (749 952 551)

962 492 Bonded(0.13%)

Deal Structure

SEI Labs has raised a total of $5Million in funding over 1 round. Their latest funding was raised on 31 August 2022 on a Seed round

Team

CORE TEAM

Core team

Jayendra Jog -Co-founder. Prev. Software EngineerSoftware Engineer at Robinhood

Jeff Feng. - Co-founder. Prev. Venture investor (Crypto Hedge Fund), IB Goldman Sachs,

Dan Edlebeck - Head of Ecosystem. Prev. 4yrs Founder deedle connects - Blockchain marketing agency

Comparable

Maverik Protocol

- Homepage: https://www.mav.xyz/; Litepaper

- Product: AMM on ETH, Optimism

- Use-Case: Next gen LP strategies. set of tools to let LPs design and automate individual strategies for concentrating and moving liquidity.

- Product: The first and only AMM that provides native Directional LPing. Give users control over their liquidity - empowering users to choose their strategy with one AMM (no need to hedge with multiple protocols)

- Stats: Discord 29,7K; Twitter: 58K; TG: 22,9K

- Funding Round & Valuation: February 15 2022, $8 Mil Strategic round, led by Pantera Capital

Injective

Injective was created using the Cosmos SDK and is able to achieve instant transaction finality while sustaining lightning-fast speeds. INJ is the native deflationary scarce asset that powers the Injective Protocol and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by Pantera Capital.

- Homepage: https://injective.com/

- Product: Custom interoperable layer one protocol for building powerful exchange, DeFi, derivatives & Web3 applications

- Stats: TW: 33K, Discord: 4.6k , Telegram: 4.3k

- Resources: Injective Raises $40,000,000 to Advance Web3 Finance; Introducing the Injective Token: Pioneering a New Decentralized Economy

Test-Net - Useful links

Guides:

Rewards

The Seinami incentivized testnet will be open to the public on June 1st, 2022 and will run for a duration of 2 months. After the event period is over, all mission submissions will be vetted, points will be tallied, and token rewards will be allocated according to points accrued.

Token rewards will be distributed to all winners following the mainnet launch. There will be a 1 year lockup period.

Analysis by Mark Mercatali. Disclaimer: This analysis is based on personal opinion only. This is not intended as investment advice. Do your own research. All company data is owned by the respective owners.