If you are an institution looking to generate yield on either your own or customer assets, AQRU can help.

- Institutional grade Custodial and non-Custodial solutions available

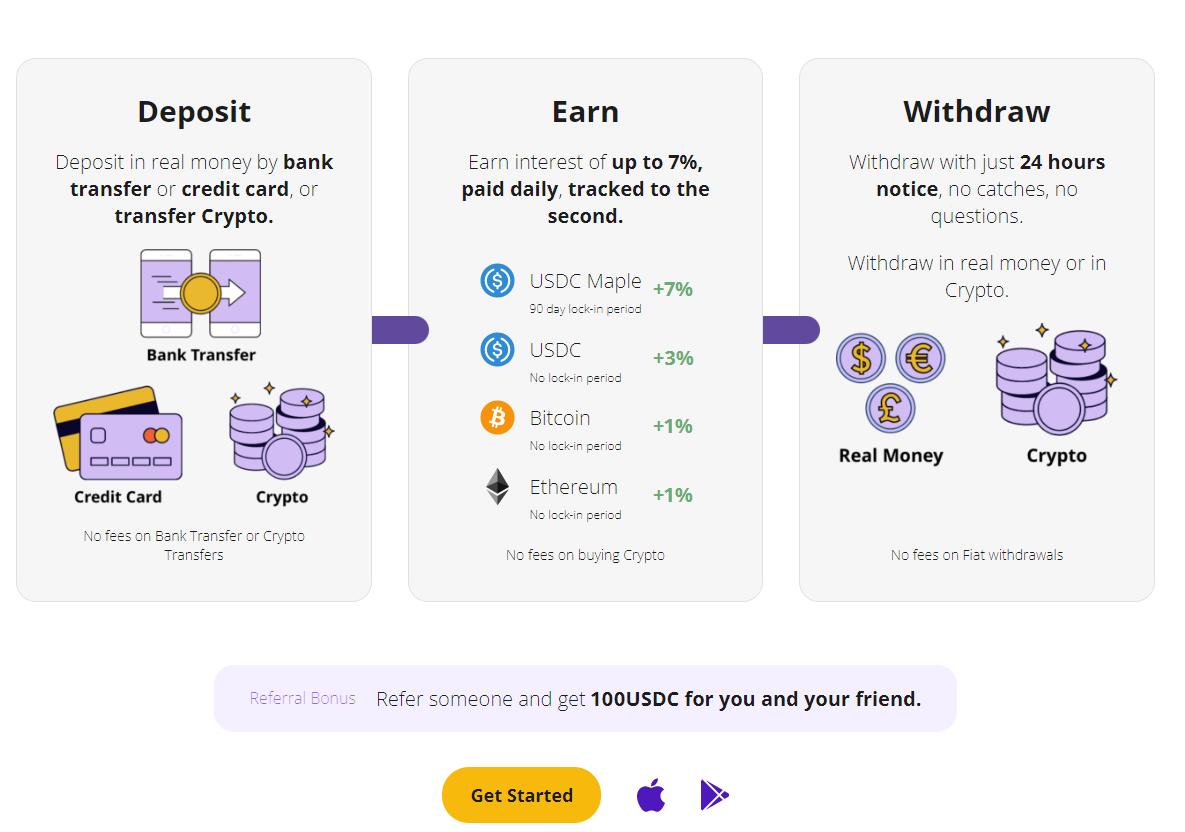

- Yields start at 7% for USDC Maple (with a 90 day lock-in period), 3% for Stablecoin assets (with no lock-in period) and 1% for BTC & ETH (again with no lock-in period) with bespoke deals available for large balances

- Treasury consultancy service available

- Bespoke services available for Crypto Exchanges, Family Offices, PSPs and more

To learn more contact the team at help@aqru.io.

Fees:

When you withdraw funds from the platform there is no fee for fiat withdrawals. There is a $20 for crypto withdrawals, charged in the asset you are withdrawing. We have a single all-in cost of 0.35% commission for each “sell” transaction, charged in the asset you are exchanging to.