About the company

Brex is a California-based fintech company that creates business financial products.

Besides Brex Cash, a “business banking alternative,” the company primarily provides business-oriented charge cards with distinctive rewards programs that are available with no personal guarantee. Brex Cash customers can apply for the Brex 30, but must still meet the card’s stricter financial requirements ($50,000 in the bank for venture-backed companies, $100,000 otherwise).

Announcement

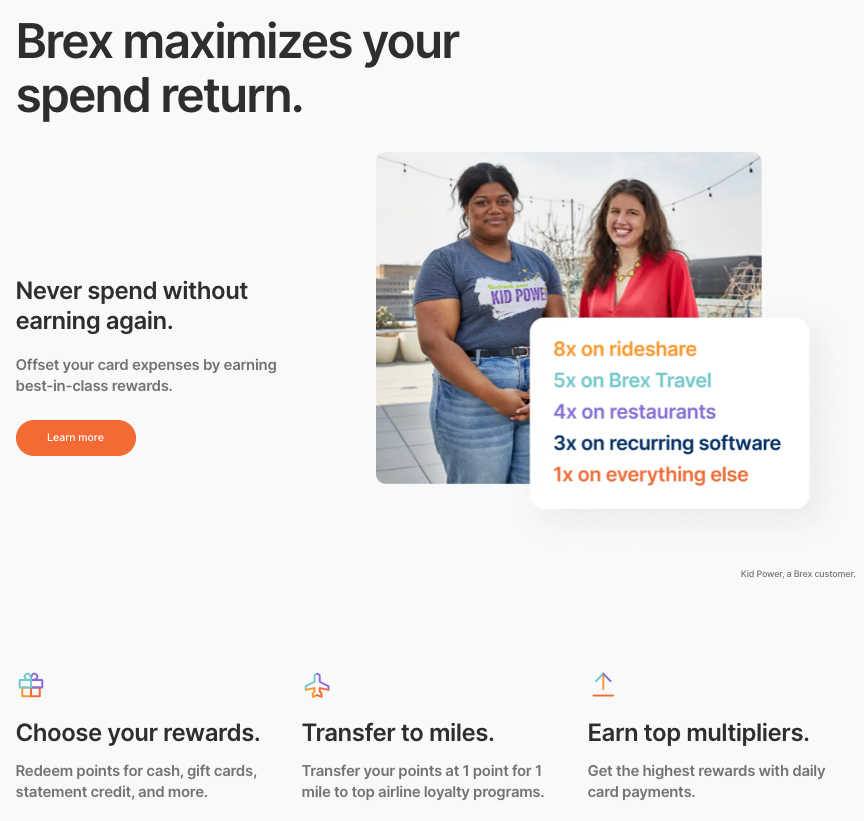

Choose your rewards

Redeem points for cash, gift cards, statement credit, and more.

Transfer to miles

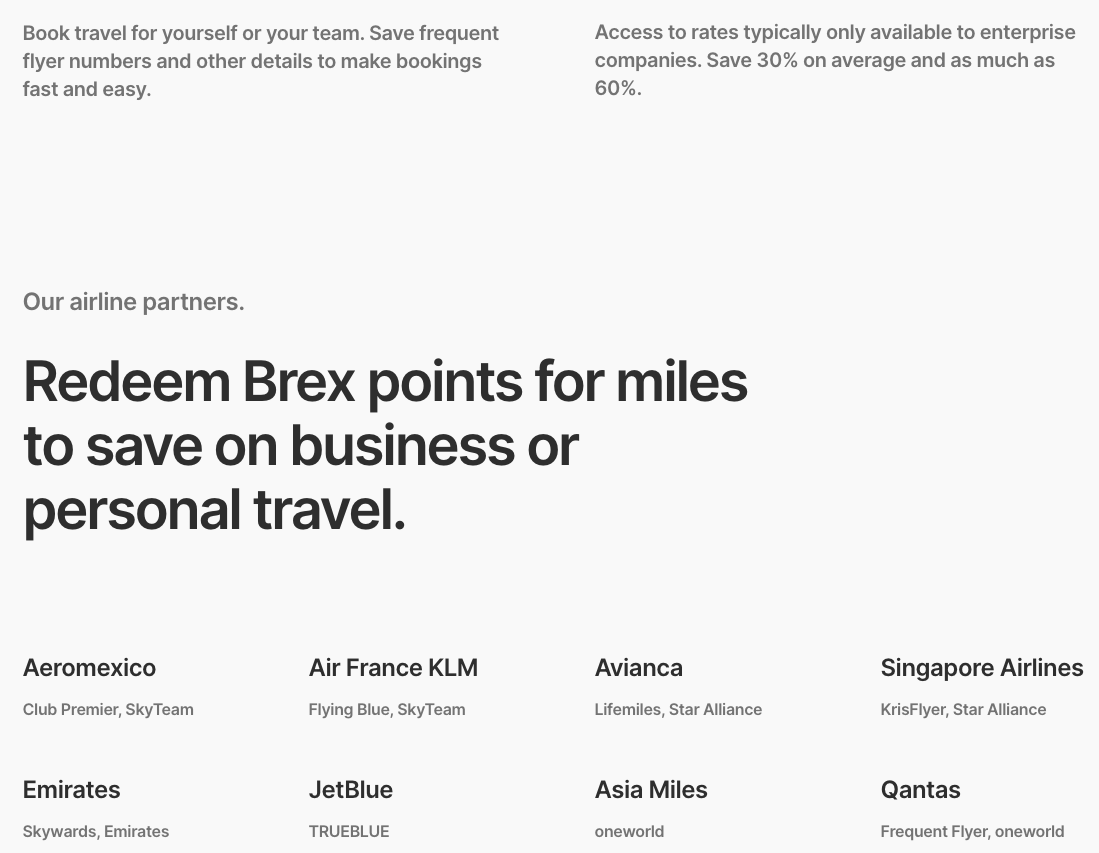

Transfer your points at 1 point for 1 mile to top airline loyalty programs.

Earn top multipliers

Get the highest rewards with daily card payments.

Want 10-20x higher limits than typical corporate cards and monthly billing? Apply for or grow into this card.

Charge cards: Both Brex cards are charge cards. That means they’re interest-free, because the balance must be paid off in full every billing cycl

Reward Scheme

Spend Points return

8x on rideshare

5x on Brex travel

4x on restaurants

3x on recurring software

1x on the rest

Each point earned can then be redeemed for $0.01 in one of three ways:

- for flights and hotels booked through Brex Travel, Gift cards, or statement credit

- For miles with an airline partner.

- For Crypto: ETH and BTC (If you have created a non-custodial wallet)

If you have Brex Cash, you can redeem for cash back directly into your account.

Highlights:

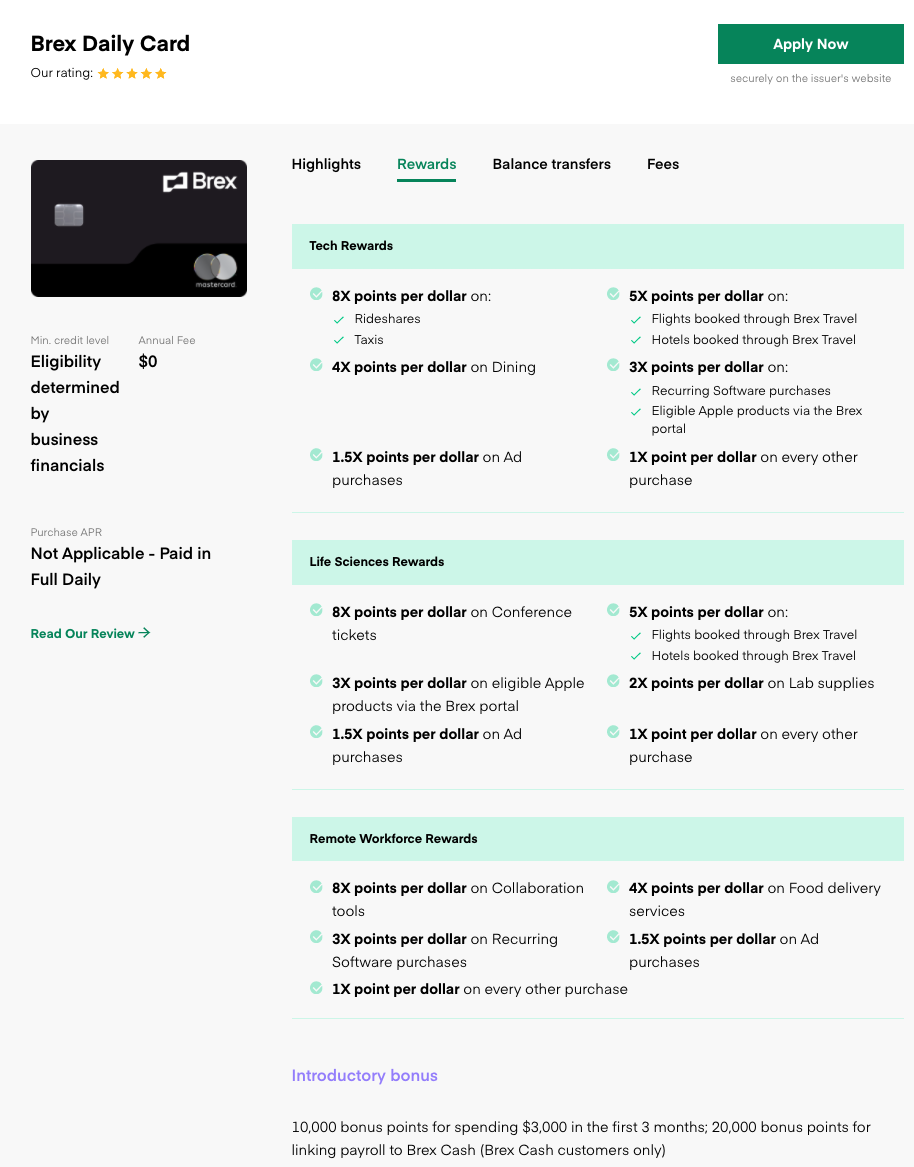

- Choose either Tech Rewards, Life Science Rewards, or Remote Workforce Rewards

- $5,000 in Amazon Web Services credit over a year

- $150 in Google Ads credit

- 5% rebate on Microsoft ad products

- 40% off your first 12 months of QuickBooks

- 25% off an annual Monday.com subscription

- No foreign transaction fee

- No annual fee

- Not available to consumers, sole proprietors, unregistered businesses, and other non-individual liability companies

The Brex Daily is automatically paid daily from the money in your Brex Cash account, a lot like a debit card, though using it still builds credit. It’s only available to Brex Cash customers (more on that later), but Brex Cash has a low barrier of entry, which makes the card easy to get even for small businesses.

Features

Qualification Brex Exclusive

Brex points are uncapped and never expire.

Value Proposition

- No personal guarantee required: Neither Brex card requires a personal guarantee, which means your business is liable for its debts — not you.

- Intelligent receipt capture

- Accounting/ERP integrations: QuickBooks, Xero, NetSuite, and Expensify integration simplifies the expense tracking process using Brex transaction data.

- Unlike other card programs that cut off your multipliers after you hit a certain spending limit, Brex rewards multipliers are always uncapped, and there’s no minimum or maximum redemption value required.

- Statement credits: Including, but not limited to, $5,000 credit and up to $100,000 in AWS Activate (if eligible) for Amazon Web Services, 40% off your first year of QuickBooks, up to $150 in Google Ads credit, an automatic 5% rebate on Microsoft ads, and up to $10,000 in Quartzy credits

- Remote collaboration benefits: 20% off annual Zoom subscription, 25% off 12 months of any eligible Slack plan, 50% off an annual Dropbox subscription, 3 months of discounts on DoorDash, and 25% off an annual Monday.com subscription

- Brex Travel: Book corporate travel through Brex with an eligible card, and you may save anywhere from 30–60% thanks to negotiated rates and unique inventory. The Brex Travel portal grants you the option to save individual traveler profiles with frequent flyer information, and you can even use your Brex rewards points to book.

Brex cards aren’t available to consumers, sole proprietors, or unregistered companies.

Foreign founders are welcome, but your business must be registered in the U.S. to qualify.

-Brex Resources

Name

Tags

Brex Credit Cards: Overview and Comparison | Credit Card Insider

How do I redeem my Brex points for crypto?

Brex | What rewards does Brex offer?