About the company

SALT was founded in 2016 by a group of Bitcoin enthusiasts who aimed to prove that people didn’t need to compromise their lifestyle or forego their needs in order to pursue a long term outlook on cryptocurrency. We introduced asset backed lending to the cryptocurrency marketplace, providing a new level of versatility to digital asset holders

Announcement

First card designed to help you HODL.

Spend up to 60% of your crypto portfolio balance. As your portfolio grows, so does your purchasing power. let your portfolio (not your credit score) determine your credit limit.

Reward Scheme

Value Proposition

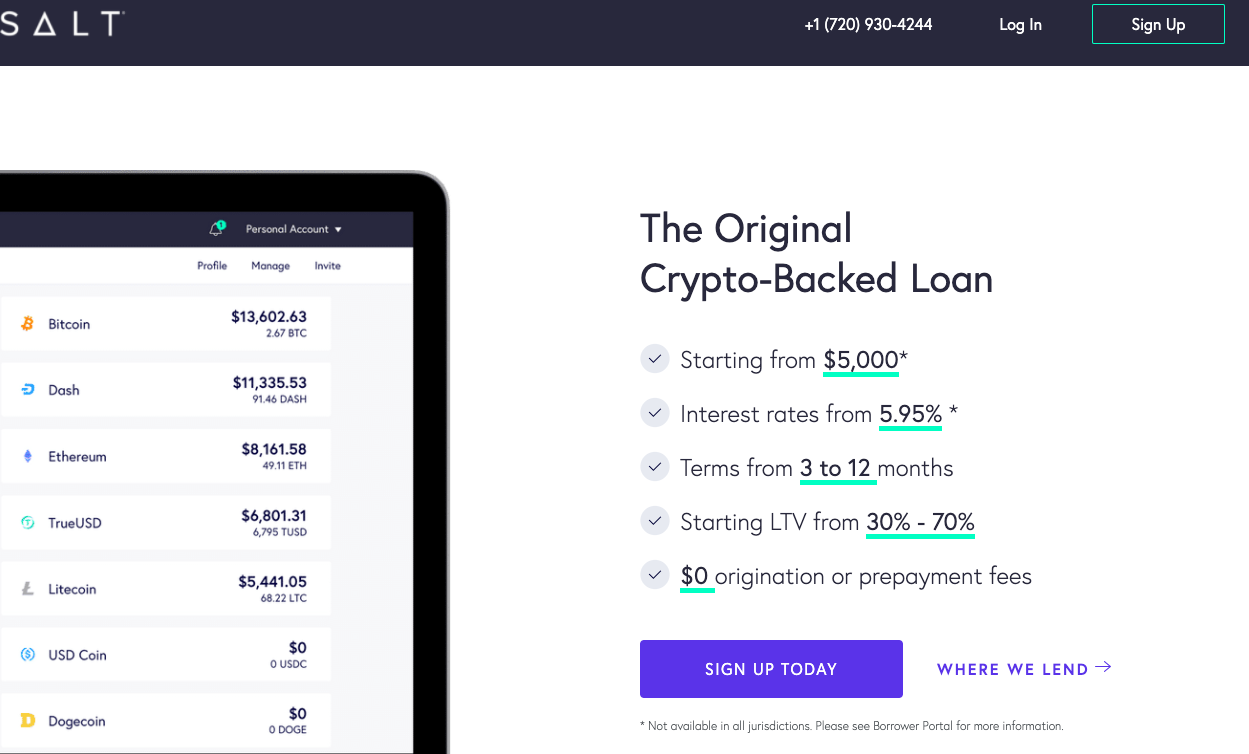

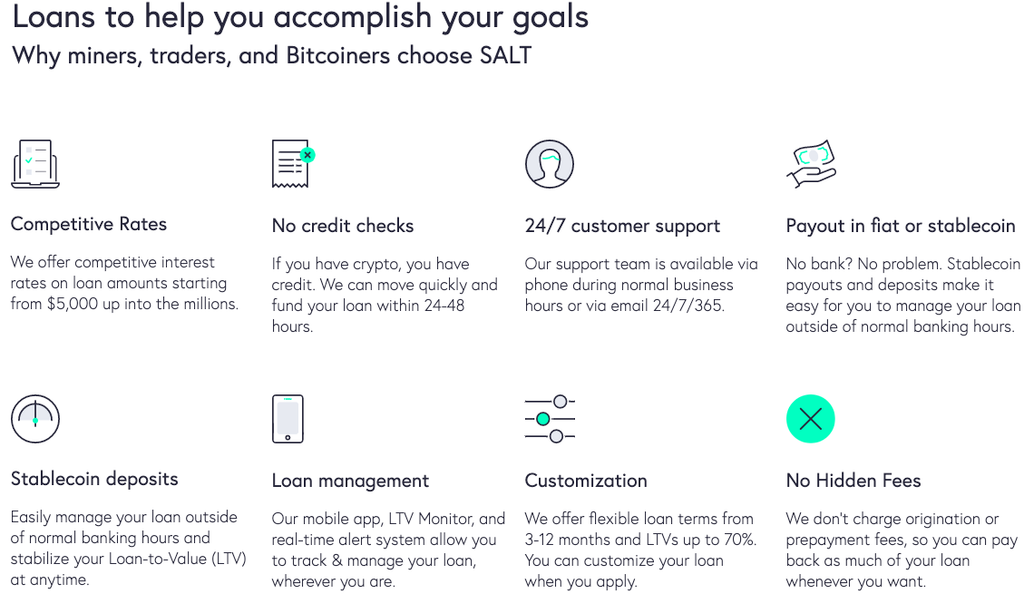

- 3-12 month term

- 0% origination fee

- LTV: 30-40-50-60-70

- No credit checks

- Portfolio Stabilization mechanism (When the market starts crashing and your Loan-to-Value ratio (LTV) reaches 90.91%, we convert your entire crypto portfolio to USDC to preserve its value.* Once you reduce your LTV to 83.33% or below by making a payment or depositing additional collateral, you’ll have the opportunity to re-enter the market).

Timeline for the Credit card:

We are still ironing out the details with a preferred card provider. We have a very specific product in mind and we won’t roll out anything unless it’s the preferred product. At this time we have opened up our waitlist and survey for those that want to stay in the loop and be first in line to apply for the card.

The plan so far is that your crypto will be your credit - you’ll use your crypto as the collateral for the credit line and when you spend the merchant will receive US dollars.

We don’t have a timeline yet on when it will be launched. Stay tuned!

-SALT Resources

Name

Tags

Rates and Fees - SALT Lending | USD or Stablecoin Crypto & Blockchain Loans

SALT Stabilization: How it Works