The aim of this research is to introduce the Staking and Lending Market players and compare them to their DeFi Counterparts.

What to expect:

Infrastructure staking providerMarket OpportunitiesSourcesDeFi protocols1 - Lending & Borrowing Protocols2 - Yield Aggregators / Auto-Compounders3 - Incentivized liquidity protocols 4 - Leveraged Farming:5 - Institutional /“Permissioned” DeFi 6 - IndexesFAST LINKSResources

Industry leaders - Staking

- Leading global incumbent player with a leading offer: Kraken

- Leading European incumbent player with a leading offer: CEX.IO

- Benchmark of the crypto industry: Binance

- Emerging player focused on product expansion: FTX

- Large offer and dominant global player: OKEx

- Leading US player: Gemini

- Large offer and dominant global player: Crypto.com

- Best for Overall Product offering: Binance (Locked Staking: 85, Defi-Staking: 13, Locked Savings: 10, Flexible saving: 141)

- Best for Highest Yields: YouHodler

Strategies

- Staking POS coins

- Staking non-POS coins

- Lend Cryptoassets

- Lend Stablecoins

- Liquidity Mining

CEFI Leaders:

- Best for EURO Market: NEXO

Best for Coin offering:Celsius

Best for US Market:BlockFi

DEFI Leaders:

- Best for Stablecoin Yields: Compound

- Best for Crypto Yields: Bancor

- Best for Coin offering and Cross-chain: Curve

- Best for TVL: Curve, Lido, Convex, AAVE

Made by Macromark.eth.

Navigator:

Infrastructure staking providerMarket OpportunitiesSourcesDeFi protocols1 - Lending & Borrowing Protocols2 - Yield Aggregators / Auto-Compounders3 - Incentivized liquidity protocols 4 - Leveraged Farming:5 - Institutional /“Permissioned” DeFi 6 - IndexesFAST LINKSResources

Infrastructure staking provider

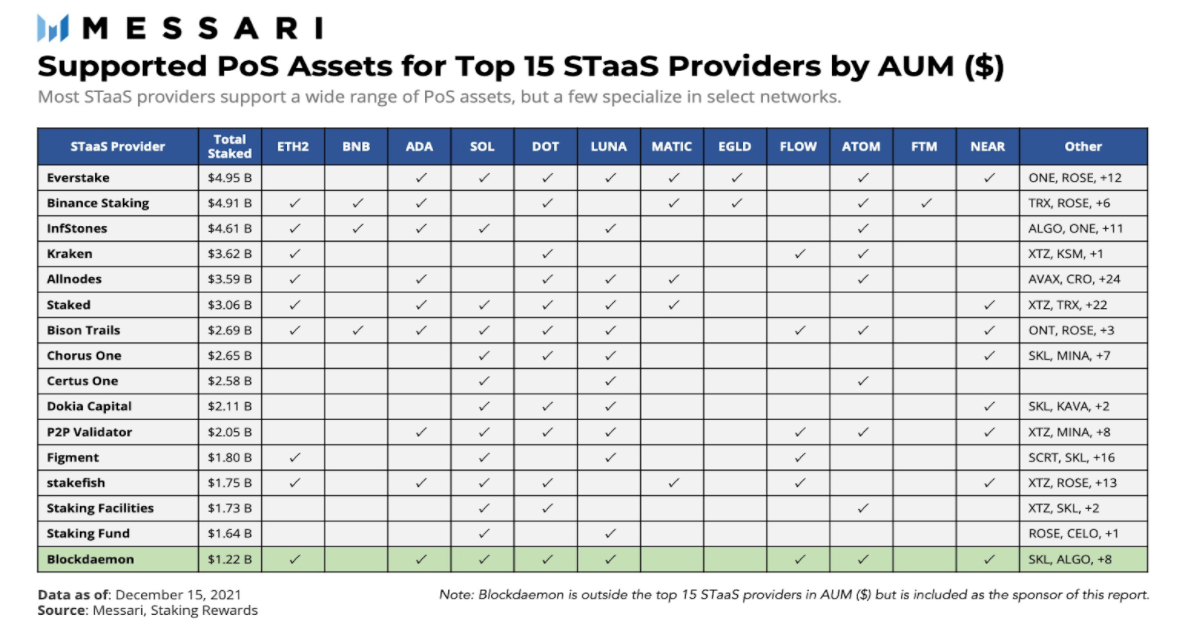

- tier group of infrastructure staking provider: Independent player (shortlist candidates)

- tier group of infrastructure staking provider: Largest player(Messari research)

Market Opportunities

- Lending & Borrowing

- Liquidity mining

- Direct staking and Node Running

Lending protocols - Screening

Providers

Name

Score

Type

URL

Assets

Interest

Risk indication

Description

YouHodler

A

CeFi

L&B

https://www.youhodler.com/

collateral: 49 cryptos/ borrow: USD, USDT, CHF, EUR, GBPlending: 55 cryptos

ReputationTrust- pawnbroker authorisation in Switzerland- member of the SRO PolyReg and operates as a financial intermediary in accordance with art. 2 par. 3 Swiss Anti-Money Laundering Act (AMLA-CH)Security - partners with Ledger Vault to provide digital asset management system and $150M pooled crime insurance- 2019: exposed unencrypted user credit cards & transactions- We store fiat funds at reputable Bank accounts in Europe and Switzerland and partner with trusted fiat payment providers only.

YouHodler is a cryptocurrency exchange and lender that pays good interest rates on crypto deposits. Customers can use crypto as collateral on short-term loans, and use borrowed funds for advanced trading.

CoinLoan

A

CeFi

L&B

https://coinloan.io/

collateral: 18 cryptos/ borrow: 15 currencies (fiat + crypto)lending: 26 cryptos

ReputationTrust- licensed in Estonia - providing virtual currency services- FinCen MSB license. Bank-grade protection, AML control, KYC checks, BitGo $100 mln insurance.

CoinLoan was established in 2017, and it is a well-known P2P lending platform headquartered in Estonia. This platform offers users high loan-to-value rates while offering the best-fixed interest rate for those who would like to earn passive online income.

Inlock

A

CeFi

L&B

https://inlock.io/

Lending: 16 cryptos collateral: BTC, ETH, LTC, BNB/ borrow: USD

Reputation- 17k customers Security - Fulfilling all AML/KYC requirements by EU FIU- assets stored in Fireblocks wallets

Inlock is Central-Europe's leading crypto finance platform.The Inlock platform allows customers to unlock their crypto’s full potential with easy-to-use & secure services whether they’re new to crypto or already crypto pros.The platform enables users to⁃ Earn market beating interest on their crypto & stablecoin deposits with no lock-ins or fees, interest paid weekly⁃ Get liquidity with tax-efficient, instant crypto collateralized loans with up to 90% LTV⁃ Swap between crypto and stablecoin assets conveniently to save time & feesAll the while ensuring military-grade security and regulatory compliance of all digital assets within the Inlock Wallet.

Spectrocoin

A

CeFi

Borrowing

https://spectrocoin.com/

collateral: BTC, ETH, XEM, DASH/ borrow: EUR, BNK, USDT, BTC, ETH, XEM, DASH

Trust- 2 crypto licenses in EstoniaReputation-1m users, 9 Years operating

Spectrocoin has climbed to the forefront of the rankings for two main factors. First, it's free. Second, and most notably, it makes it possible for the instant transfer of funds. The balance between these two factors has resulted in Spectrocoins becoming a popular gateway currency in industrialized regions such as Italy, Australia, France, and others. Spectrocoin is highly compatible with almost all powerful ecommerce operating systems, including Magento, PrestaShop, OpenCart, WooCommerce, and others.

Squilla

A

CeFi

L&B

https://squilla.loans/

Only Stablecoins

Trust: Licensed cryptocurrency companySecurity: Audits and penetration tests by security leader, cold wallet storage, 256-bit encryption, fullfilling all AML/KYC requirements

Smart Credit io

A

DeFi

https://smartcredit.io/

ETH, USDT, MKR

Reputation: 15,000 users

Provider of a financial platform software designed to lend cryptocurrency based on Ethereum blockchain technology. The company's software offers a decentralised marketplace to promote peer to peer lending and borrowing through transferable ether tokens, insured and interest-bearing as well as providing automated crypto credit scoring to rate borrowers and lenders based on their history, enabling users to ensure financial liquidity with full security along with earning steady income via currency market.

Abra

NEW

CeFi

L&B

DOT, MATICM BTC, ETH, TUSD, USDT, USDC, USDP, ADA, LTC, BCH, XLM, CPRX

Up to 8.5% Stable

1.75% BTC

2.65% ETH

10% DOT

+1.5 bn AUM, Abra has raised a total of $148.6M in funding over 10

rounds. Backed by Arbor Ventures, HCM Capital IGNIA, American Express Ventures, Blockchain Capital IGNIA

NEW

CeFi

USDC, USDT, BUSD, DAI, BTC, ETH, SOL, MATIC, AVAX, NEAR, SAND, BNB, DOT, XRP, ADA, ATOM, APE, DOGE, SIDR, SXGD, AXS, SLP, RON

12% Stables *tiered

5% BTC

5% ETH

5% ADA

8% AVAX

90% AXS (AXIE SHARD)

When you deposit your digital assets, they will be held by our custodial partner Fireblocks, enterprise-grade security, insurance, and 24/7 access to digital assets.

Earn 15% APY on stablecoins such as USDC, USDT, and DAI.

Earn 5.75% on BTC and ETH, regardless of your deposit size.

No minimums, no lock-ins, and no limits on when you can withdraw. And no fees!

SendWyre - Wyre+ Rewards

NEW

CeFi

Wyre: ALGO, AVAX, BTC, ETH, FLOW, LRC, MATIC, XLM

BTC 1.5%

ETH 2%

DAI 5.5%

USDC 5.5%

Offering lots of different integrations with its white-label services.

Rewards API: Partners can choose how to divide rewards between themselves and their users which makes this service a potentially powerful tool for monetization.

B2C based on Wyre: https://outlet.finance/about, https://www.donut.app/

AQRU

NEW

CeFi

L&B

USDC, BTC, ETH

7% Locked USDC on MAPLE

3% No lock-in

1% BTC, ETH

Fireblocks to ensure security of assets. We also have a $30 million policy in the event assets are stolen. Accru Finance Ltd. (Bulgaria) is a company registered in Bulgaria with registration number 206651201 whose registered address is 9 Tsarigradsko Shose, 1124, Sofia, Bulgaria. Accru Finance Ltd. (Bulgaria) is a subsidiary of Accru Finance Ltd. (UK), a private limited company registered in England and Wales with registration number 13133682.

up to 7% interest on USDC stablecoins, 1% on Ethereum and 1% on Bitcoin and it is all yours to keep.

Nebeus

NEW

CeFi

L&B

BTC, ETH, USDC, USDT

6.75% BTC, ETH

12.85% USDT, USDC

The platform is developed and managed by Rintral Trading SL, Carrer de la Ciutat de Granada, 150, 08018, Barcelona, Spain.” and are registered in the Commercial Registry of Spain.

Registered in London (6.3 Million founding) https://www.crunchbase.com/organization/nebeus

B2C - The deposit period is 4 to 36 months. During the deposit period, the payout is credited to your account monthly, but your cash earnings can be withdrawn every 24 hours.

Argent Vault

NEW

CeFi

DeFi

Lending

ETH, DAI, USDC, WBTC + indexes

up to 6% ETH

up to 1.68% DAI

1,07% USDC

0.16% WBTC

Backed by Paradigm, Starkware

Tech implementation - Based on StarkNet (Layer 2 ETH, Zk-Rolloup)

CoinRabbit

B

CeFi

L&B

https://coinrabbit.io/

collateral: 25 coins / borrow: USDT, USDC, BTC, ETH, DOGE, DGBlending: USDT (ERC-20, TRC-20), USDC

Partners with ChangeNow and GuardaTrust- no mention of license.

Assets used for collateral are kept in cold storage - no KYC- claims deposits are insured with no details.

CoinRabbit is a crypto lending platform that facilitates loans between investors and borrowers. Borrowers can use the loans for any form of spending, including further crypto investing.

Notional

B

CeFi

L&B

https://notional.finance/

Lending and Borowing: DAI, ETH, USDC, WBTC

Coinbase Ventures Seed investor, $420m Total Value Locked,$399m Total Loan Value,767 users

Developer of an online financial platform intended to provide fixed-term lending and borrowing of crypto-assets. The company's platform allows crypto users to borrow and lend assets at fixed rates of interest using a token called fCash, enabling users to optimize capital efficiency and effectively balance the needs of liquidity providers.

Lenda Bit

B

CeFi

L&B

https://lendabit.com/

collateral: BTC, ETH/ borrow: USDTlending: USDT

42,712 users, Partners: Bitifnex, Poloniex, Kraken etc.

Qualified custodian service for $100m, Partnering with BitGo, compliant with all KYC and AML requirements

The platform has been designed to remove all unnecessary steps from the lending process, thus more attractive terms and conditions to both lenders and borrowers. The customer interface and data processing behind it are structured so as to support prompt and secure transactions. Normally, making a loan or lending should require just a few clicks.

Constant

B

CeFi

L&B

https://www.myconstant.com/

Collateral: 70+ crypto/ Borrow: 70+ cryptos + USDLending: AAVE, ADA, ALGO, ANKR, ANT

Collateral stored in Prime Trust cold wallet, an ETH smart contract, or password-protected web wallet

Vauld

B

CeFi

L&B

https://www.vauld.com/home

100+ cryptos

Backed by Valar, Coinbase Ventures, Pantera

Developer of a lending platform designed to manage crypto seamlessly. The company's platform offers a customer-centric banking service leveraging blockchain that intends to treat the cryptocurrencies as a separate asset class by offering services that ensure technologies based on the blockchain are usable, enabling users to lend, borrow and trade with ease.

Yield App

B

CeFi

Lending

https://www.yield.app/

BTC, DAI, ETH, USDC, USDT, TLD

European cryptocurrency license (DASP)- Provider of Virtual Currency License in Estonia

Provider of decentralized finance banking services intended to unlock the full potential of Defi and make it available to the world. The company's platform offers various investment funds to choose from and offers higher returns than traditional savings accounts and other alternative investment schemes, enabling its users to earn returns without having to go through a lengthy, complex, and costly learning process.

Swiss Borg

B

CeFi

Lending

https://swissborg.com/

11 cryptos

$0.77B Total value of assets in Yield Wallets- Top 100 Swiss Fintech Startups 2021- 170,168 Total number of active Yield WalletsTrust- Virtual Currency Service license in Estonia

Provider of cyber bank platform created to provide wealth management services with a community centric approach. The company's cyber bank platform is powered by ethereum and uses deep learning algorithms that offers smart mandate, investment strategy and rewarding model, enabling individuals to optimize their cryptocurrency holdings.

Ledn

B

CeFi

L&B

https://ledn.io/en/

Bitcoin, USDC

2% over 0.1 BTC (5.25% Up to 0.1)

7.50% USDC

Coinbase Ventures Series A investor

Security- BitGo Custodian

Developer of financial products designed to help more people save on digital assets. The company offers interest-bearing bitcoin and USDC savings accounts that pay interest on bitcoin or USDC with no minimums as well as also provide bitcoin-backed loans, enabling clients to access dollars or additional bitcoin without selling their existing holdings, thereby growing their digital wealth.

Money Token

B

CeFi

L&B

https://moneytoken.eu/

lending: USDT, BTC, ETHCollateral: BCH, ETH, BTC, BNB/ borrow: USDT, DAI

The MoneyToken platform allows you to borrow liquid funds instantly based on the current value of your cryptocurrency asset holdings. You take out a crypto loan, collateralized with more volatile assets such as Bitcoin or Ethereum - and in return you receive an agreed loan amount in a stable currency. And after repaying the loan you receive your whole collateral back; even if the collateral has increased in value multiple times. With MoneyToken you are able to get money for your immediate needs and save your crypto position, all at the same time.

Bitcoin IRA

B

CeFi

Lending

https://bitcoinira.com/

Lending: BTC, ETH Investing: 60 cryptos, Gold

Reputation- Partners: Digitaltrust, BitGoSecurity- 256-bit encrypted SSL trading, stores digital assets offline in separate cold storage accounts, and insures its digital assets up to $700 million, partnerhsip with Cloudflare, $100m Custody Insurance (BitGo)

Developer of Individual Retirement Account (IRA) platform intended to allows people to invest in cryptocurrencies and gold in their retirement accounts. The company offers a trading platform for self-directed retirement accounts that allows clients to set up a qualified digital asset IRA account, transfer funds from an existing IRA custodian, execute trades in real-time, round the clock through a leading exchange and then move the funds into industry-leading multi-signature digital wallet, thereby enabling users to have better retirement lumpsum.

Matrixport

B

CeFi

L&B

22 cryptos (19 overlap with BP offering)

BTC, ETH

USDC, USDT, DAI

17 Altcoins

BTC 4.50%

ETH 5.50%

USDT 9.00%

USDC 9.50%

DAI 1.40%

Trust

-2 Licenses

Security

Cuctus custody, Insurance fund

Developer of a blockchain-based crypto trading platform designed to trade, entrust, invest and borrow crypto assets. The company's platform offers digital currency trading, institutional custody, lending as well as asset management, enabling users and clients to take control of their finances and capital.

Solend

B

DeFi

L&B

https://solend.fi/

Borrowing and lending 20 cryptos

Reputation- Coinbase Ventures Seed investor

Solend is an algorithmic, decentralized protocol for lending and borrowing on Solana.

bZx protocol

B

DeFi

L&B

https://bzx.network/

Collateral: 14 cryptos Lending: ETH, BSC, Polygon

- $55M stolen in 2021 (Kaspersky attributed the hack to a North Korean hacknig group)

Build applications that empower lenders, borrowers, and traders with the most flexible decentralized finance protocol on Ethereum. Torque is a powerful DeFi platform for borrowing assets with indefinite-term loans and fixed interest rates. Get an instant, crypto-backed loan with no KYC or credit checks. Fulcrum is a powerful DeFi platform for tokenized lending and margin trading.

Cake Defi

B

DeFi

Lending

https://cakedefi.com/

lending: BTC / ETH / USDT / USDC

Reputation- total raised $6.4MTrust- currently applying for the Payment Services License in Singapore

Developer of DeFi platform designed to generate cash flow out of crypto assets by bringing decentralized finance to people. The company's platform users various options for earning passive income from their own crypto assets such as lending crypto, liquidity mining and staking of cryptocurrencies, empowering users to generate cash flow and earn interest on their crypto assets.

Vesper

B

DeFi

Lending

https://vesper.finance/

n.a.

Developer of a decentralized finance platform designed to deliver ease-of-use in achieving crypto-finance objectives. The company's platform acts as a Defi ecosystem and growth engine for crypto assets, providing a suite of yield-generating products focused on accessibility, optimization and longevity, enabling users to passively grow their crypto holdings, maintain their strategies and build their ownership of the network over time through VSP token rewards.

IconFI

B

DeFi

Lending

https://www.icon-fi.com/

BTC, ETH, USDT, USDC

Reputation- 150+ countriesTrustSecurity

ICONFi is a digital asset wealth management platform armed with the mission to #MakeCryptoSimple.ICONFi offers yield earning products on digital assets like BTC, ETH, USDC and USDT. Our users from over 200 countries enjoy up to 12% APR on their digital asset deposits. As a partner of the ICON ecosystem, users can enjoy ICX staking and DeFi airdrops directly through our mobile application

Compound

B

DeFi

ReputationTrustSecurity - reviewed and audited by Trail of Bits and OpenZeppelin

Operator of a decentralized finance lending platform intended to establish properly functioning money markets with real-time assets. The company's platform offers a series of open-source smart contracts that algorithmically adjust the interest rates for each asset in real-time, enabling users to get liquid, transparent, and predictable interest rates.

Alchemix

B

DeFi

L&B

https://alchemix.fi/

ETH, DAI, USDC, USDT

n.a

Operator of yield-backed synthetic tokens platform intended to give loans based on future earnings. The company provides loans against collaterals with no cost in exchange in form of synthetic tokens which have some yield attached to them, thereby providing users with flexible and instant loans in a decentralized form.

Nuri

C

CeFi

https://nuri.com/earning/

BTC

Developer of a blockchain technology platform designed to be used for the purpose of facilitating international money transfers. The company's platform bridges the gap between traditional currencies and cryptocurrencies, enabling clients to avail blockchain-based banking services that are faster, cheaper, and accessible to anyone from any part of the planet.

Extra Players:

- Sendwyre lending provider of Outlet.finance (Retail app)

- Nebeus - “Crypto renting”

- Argent - Access to DeFi (Lido, Yearn Compound, Aave, Indexcoop)

How to Select Crypto Lending Platforms?

- Interest Rate

- Cost

- Platform Risks

- Loan Duration

- Collateral Amount

- Minimum Deposit Limit

Sources

DeFi protocols

DeFi leverages composability – or the ability for applications to integrate and build on top of one another – to offer unique products and services through the use of smart contracts.

Operators:

- Lending protocols

- Yield Aggregators

- Incentivized Liquidity

- Leveraged farming

- Permissioned DEFI

- Indexes

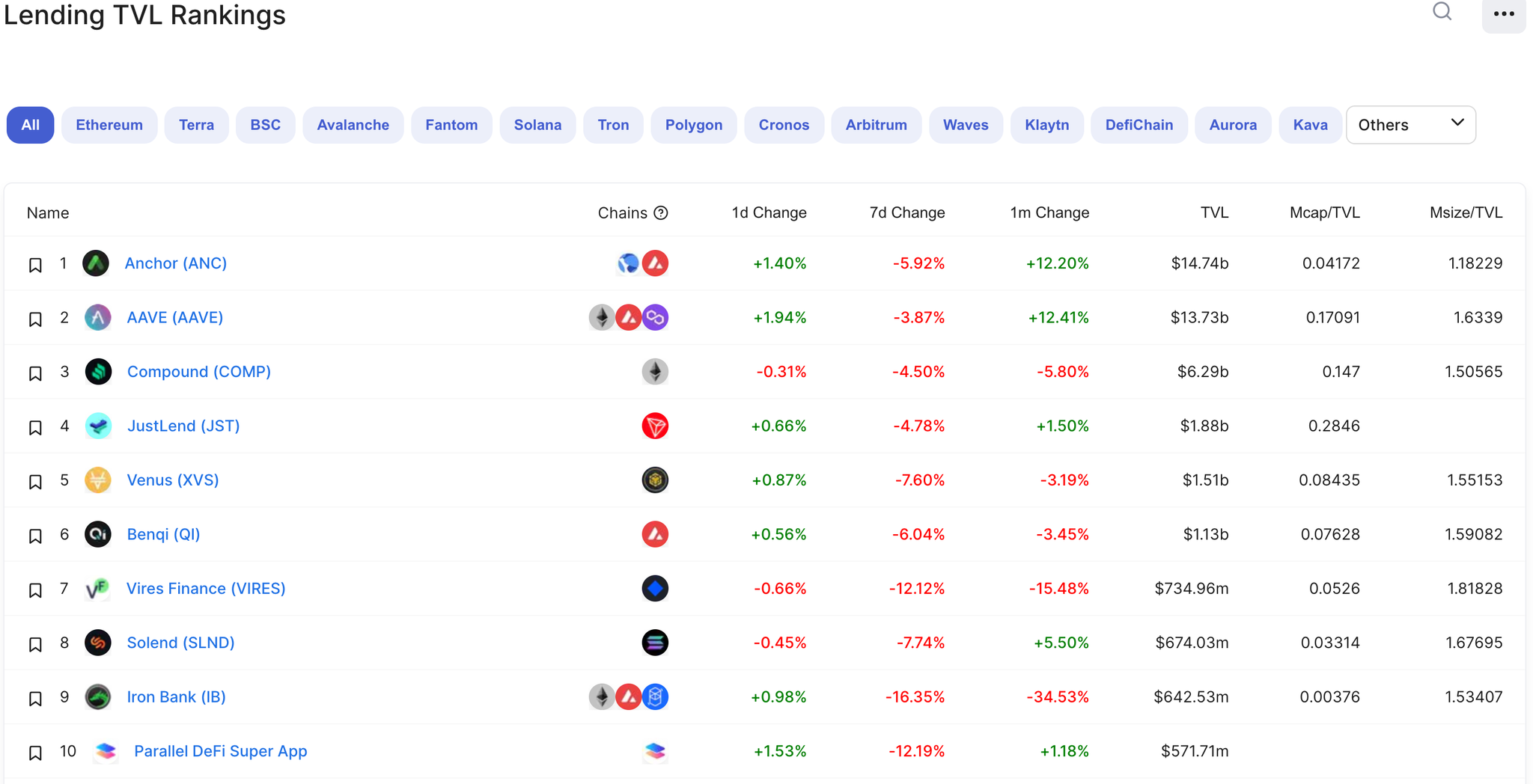

1 - Lending & Borrowing Protocols

- Best for Ethereum: AAVE (AAVE), Compound, Iron bank

- Best for BSC: Venus (XVS), CREAM Finance (CREAM)

- Best for Avalanche: AAVE (AAVE), Benqi (QI)

- Best for Fantom: Geist Finance (GEIST), Scream (SCREAM), Tarot (TAROT)

- Best for Solana: Solend (SLND)

- Best for Polygon: AAVE (AAVE)

- Best for Cronos: Tectonic (TONIC),

Reading List

Maple Finance, Solend,

Top tier lending protocol pros: • Simple & Uncomplicated • Safe • Deep pools - high liquidity • Park & forget • Low cost

Cons: • Low APYs compared to options • Not as many asset options

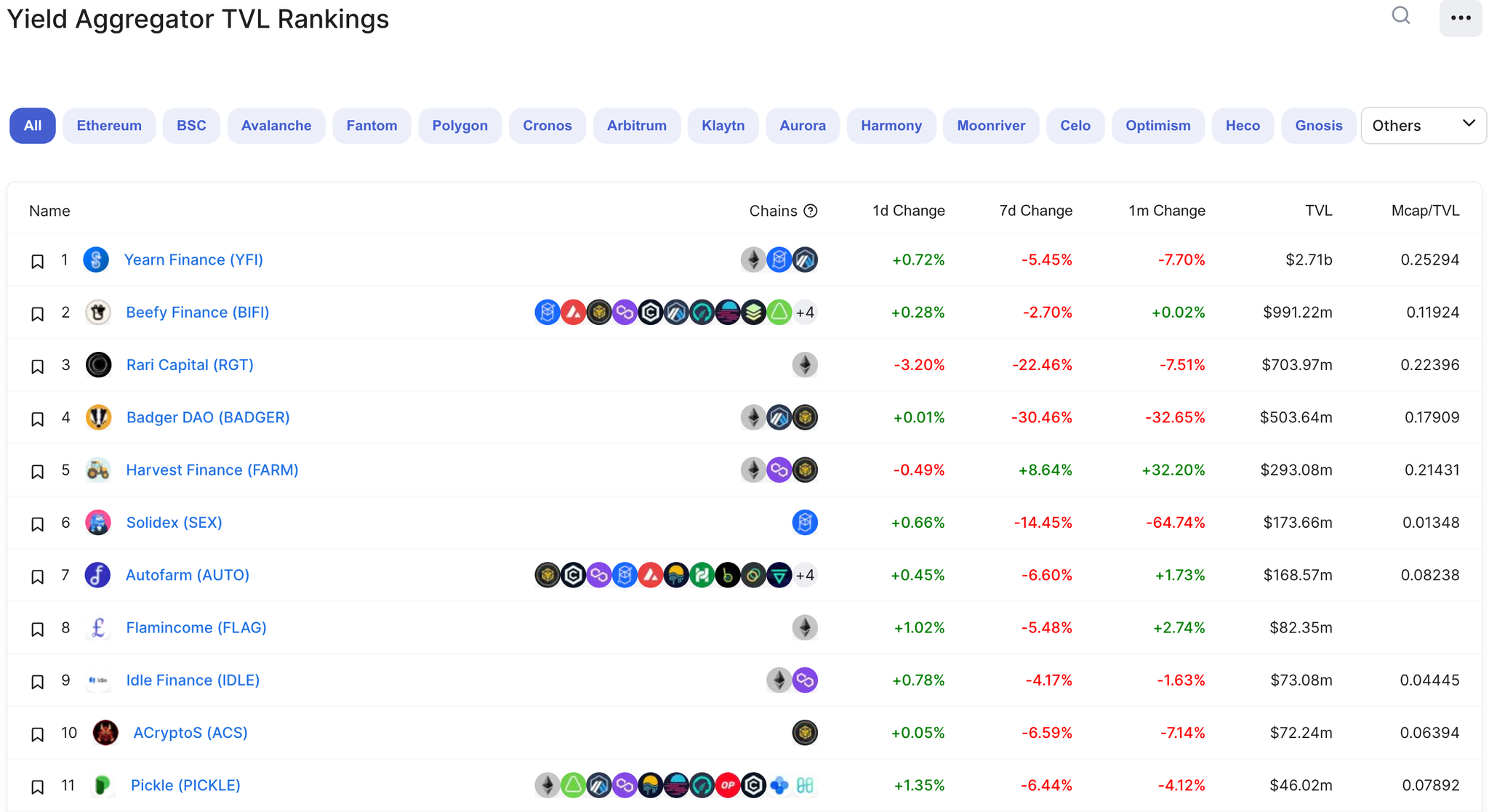

2 - Yield Aggregators / Auto-Compounders

Getting Compound interest (APY) without being exposed to farm tokens. Yield Aggregators are protocols like Yearn, where you deposit coins and they handle the farming for you. They use a range of strategies to maximize yield, while adjusting for risk

- Best for Ethereum: Yearn Finance (YFI), Rari Capital (RGT), Badger DAO (BADGER)

- Best for BSC: Beefy Finance (BIFI), Autofarm (AUTO)

- Best for Avalanche: Beefy Finance (BIFI), Autofarm (AUTO)

- Best for Fantom: Beefy Finance (BIFI), Yearn Finance (YFI), Solidex (SEX)

- Best for Solana:

- Best for Polygon: Beefy Finance (BIFI), Autofarm (AUTO), Harvest Finance (FARM)

- Best for Cronos: Beefy Finance (BIFI), Autofarm (AUTO)

Emerging:

Beefy Finance, Matrix Farm

Pros of Yield Aggregators: • Easy & Uncomplicated • Handles farming cross protocols • Potentially higher returns than lending protocols

Cons: • High fees. • More risk than lending protocols, exposing to multiple protocol risk.

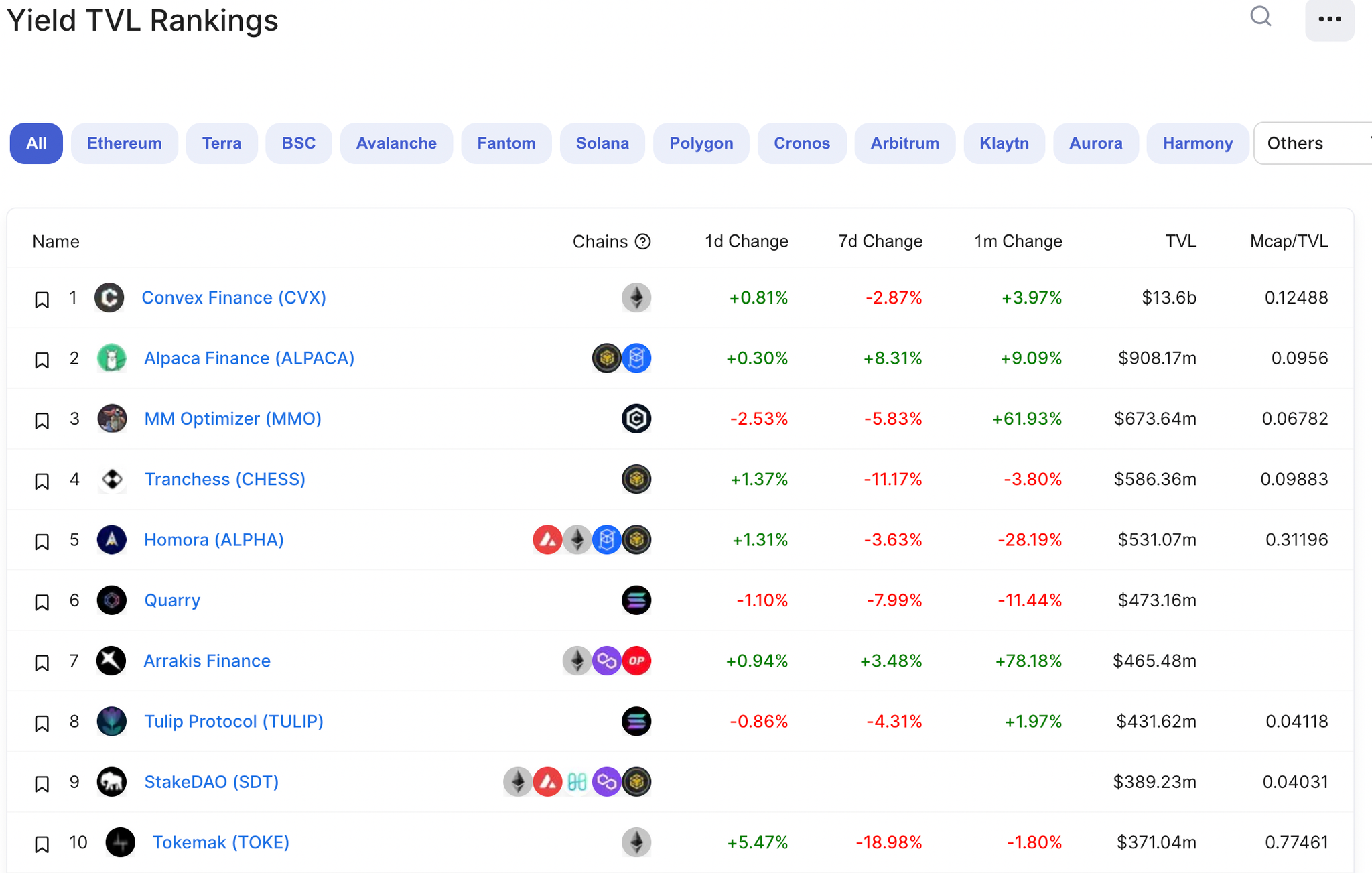

3 - Incentivized liquidity protocols

Protocols like Curve pay you in their native token for providing liquidity.

- Best for Ethereum: Convex Finance (CVX), Tokemak (TOKE)

- Best for BSC: Alpaca Finance (ALPACA), Tranchess (CHESS)

- Best for Avalanche: Vector Finance (VTX), Homora (ALPHA)

- Best for Fantom: Liquid Driver (LQDR), 0xDAO (OXD), Reaper Farm (OATH)

- Best for Solana: Sunny (SUNNY), Quarry, Tulip Protocol (TULIP)

- Best for Polygon: Arrakis Finance,

- Best for Cronos: MM Optimizer (MMO), YieldWolf

Emerging:

Convex, Tokemak

Pros of incentivized liquidity: • Higher yield • Variable APY, can be up to 10% on stables

Cons: • Greater risk • Variable APY (cuts both ways) • Knowledge curve is steeper • High Fees

4 - Leveraged Farming:

You can borrow against your position & farm. You get a greater APY, running the risk of liquidation

What Is Leveraged Yield Farming and How Can It Bring Higher Returns? - The Defiant

In DeFi, while it's not necessarily true that bigger is always better, the beauty of a high APY never fails to turn heads. And regardless of how much higher DeFi yields are compared to traditional finance, there's no shortage of DeFi users eager to maximize their profits, chasing higher yields from platform to platform and network to network.

https://thedefiant.io/leveraged-yield-farming/

Best By Chain:

- Best for Ethereum: Alpha Homora

- Best for BSC: Alpaca Finance

- Best for Avalanche:

- Best for Fantom:

- Best for Solana: Tulip Garden

Pros of leveraged farming: • Big yield (100%+ if you do it right)

Cons: • High risk • Liquidation if something goes wrong. • Not for beginners

5 - Institutional /“Permissioned” DeFi

Often these product offerings don’t add much value to the space, besides providing semi/fully-regulated gateways for DeFi attractive yields. These players could solve regulatory hurdles for a Hefty yield cut.

Fireblocks

Fireblocks: Fireblocks enables institutional access to DeFi apps for trading, lending, and staking. Our DeFi platform provides enterprise-grade protections and fully customizable governance and policy controls, making it easy for organizations to dive into DeFi without jeopardizing security. Fireblocks also provides access to the first permissioned DeFi market, Aave Arc, directly from our secure wallet infrastructure. With required KYC/KYB verification, AML-monitoring, and enterprise-grade security and governance, this represents the safest and most efficient way to access permissioned DeFi.

Permissioned DeFi goes live with Aave Arc + Fireblocks

We're excited to announce that Aave Arc, the new permissioned DeFi liquidity pool for financial institutions, is now live with Fireblocks as the very first active whitelister for the protocol. Aave Arc is a DeFi liquidity market designed to be compliant with AML regulations, with all participating institutions required to undergo Know Your Customer (KYC) verification.

https://www.fireblocks.com/blog/permissioned-defi-goes-live-with-aave-arc-fireblocks/

Maple Finance

Lending strategies

Maple Finance

https://app.maple.finance/#/earn

Maple offers borrowers transparent and efficient financing completed entirely on-chain. For lenders, Maple offers a sustainable yield source through lending to diversified pools of crypto’s premium institutions. The Pool Delegates that manage these pools perform diligence and set terms with Borrowers.

- Lenders: Maple allows Lenders to generate yield by lending to top corporates & institutions in the crypto sector. Each Lending Pool fund loans to numerous Borrowers, offering Lenders access to diversified exposure. Maple is designed to be a set-and-forget solution for Lenders, as Pool Delegates conduct due diligence on Borrowers and manage the Pools.

Strategy of the pool

Orthogonal Trading is a multi-strategy cryptocurrency trading firm focused solely on the digital asset markets.

Alameda Research are the sole borrower from this pool and will utilize capital deposited to facilitate their market making business. Launched in November 2021, this permissioned lending pool plans to extend $1BN in loans to Alameda over 12 months.

Liquidity providers to this pool must be accredited non-US institutions, and pass through KYC-AML procedures. Loans are issued to Alameda in tranches. Applications to deposit liquidity are always open, enquire via https://maple.finance/contact.

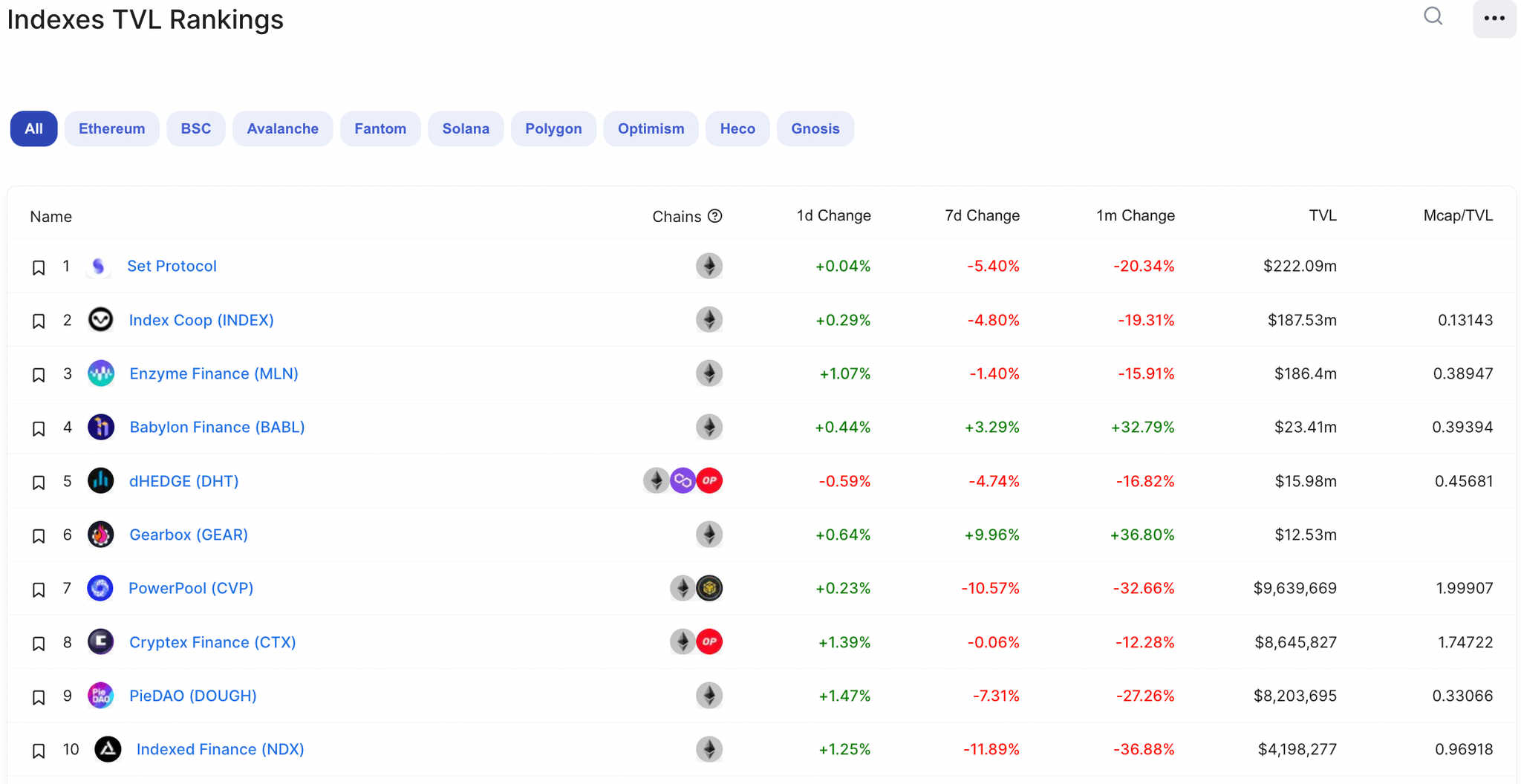

6 - Indexes

DEFI 3.0 focuses on offering “ETF” like instruments, giving exposure to specific Defi strategies or Defi market segments

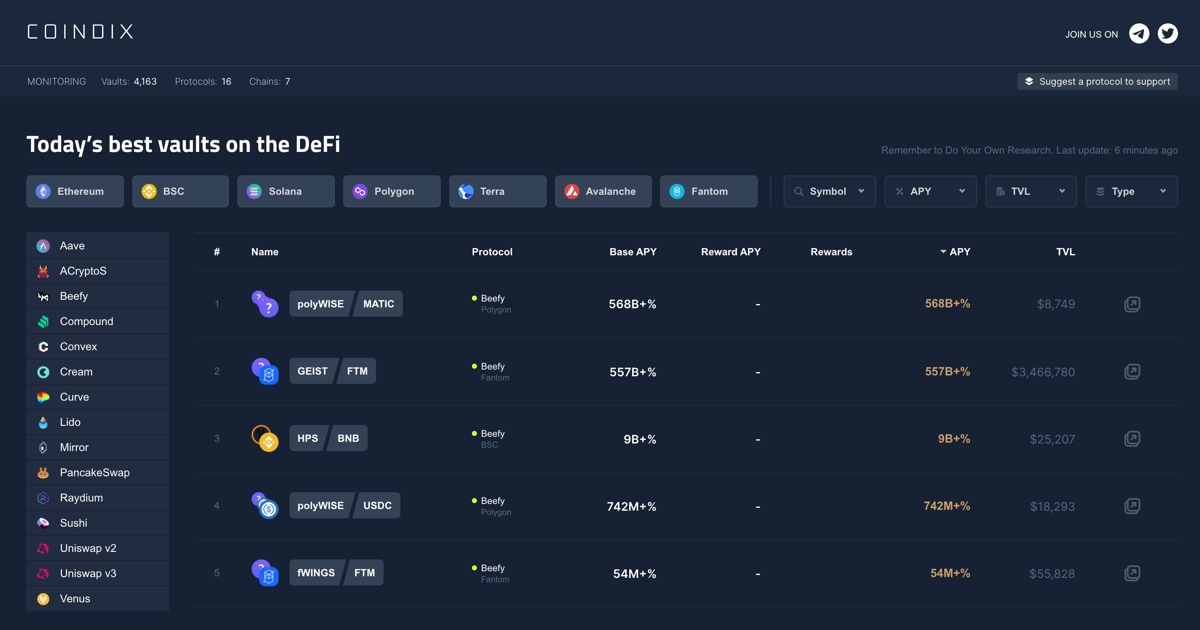

FAST LINKS

DeFi Yields:

Coindix - Today's best vaults and APY on the DeFi

Monitoring +10,000 vaults on 26 chains to find Today's best vaults on the DeFi.

https://coindix.com/

DeFi market data:

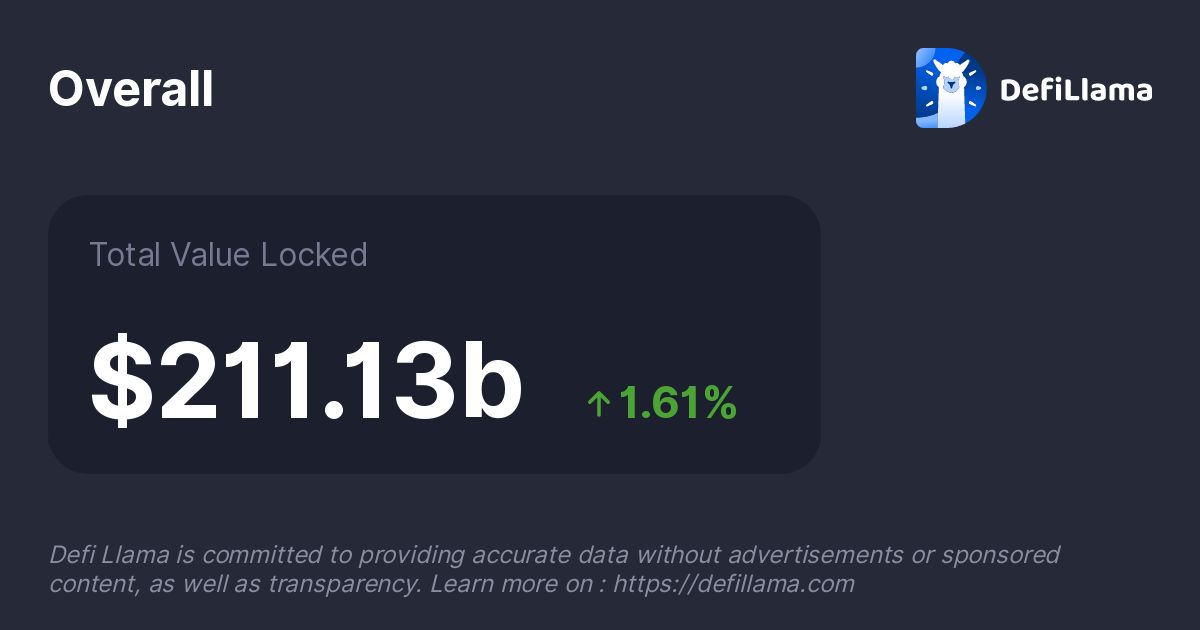

DefiLlama

DefiLlama is a DeFi TVL aggregator. It is committed to providing accurate data without ads or sponsored content, as well as transparency.

https://defillama.com/

Yield Staking Coins:

POS List | Staking Coins | Staking | Proof of Stake Coins | POS Calculator

Top Proof-of-Stake Cryptocurrencies sorted by Market Capitalization *Coin to stake is a staking monitoring and stats service. Cointostake.com does not research or recommend any coin. Do your own research and invest at your own risk. Please consider Dev Team - Community - PURPOSE/Platform - Liquidity - Wallet when making purchases.

https://cointostake.com/

Lending and Interest Rates

Crypto Lending Rates - Earn Crypto Interest by DeFi Lending

Lending markets are an important part of any currency market. The ability to temporarily acquire or offload funds - without an outright sale - has many useful applications. This is especially true in the world of crypto, which opens up vast opportunities for creating lending markets in new and exciting ways.

https://defirate.com/lend/

LoanScan: Compare High Interest Accounts

LoanScan helps you discover and access high interest accounts. Take advantage of our tools to make your money grow.

https://loanscan.io/

Resources

Staking Resources

Name

URL

Tags

Date

DeFi Data and Visualization Resources | by Vivek | Coinmonks | Medium

Insights

Yield Tool

Tools

Coinbase - Staking Product Fee Disclosure

Market

"Farming as a Service" The DeFi Edge / Twitter

Insights

CeFi Lending: GREAT Yields and Better Security?

Review

Binance DeFi Staking Launches ETH High-Yield Activity with Up to 10.12% APY | Binance Support

Market

7 Best Crypto Staking Platforms in 2022 - 101 Blockchains

Review

Best Crypto Staking Platforms for 2022 - How to Stake Crypto

Review

The Blockfi business model - How do they make money?

Player

The Ultimate List of Crypto Lending Platforms - 101 Blockchains

Best crypto interest rates 2022 - DeFi and CeFi » Brave New Coin

Table of contents

Made by Macromark.eth - For inquiries contact macrodefi.wallet@gmail.com. or DM on Twitter.

Not FA, DYOR. WAGMI